With streaming giant Netflix’s (NASDAQ:NFLX) earnings numbers now out, Netflix is now looking to improve its outlook. A major shakeup hit the company’s uppermost levels, and the company’s plan may do more than that to come. Netflix shot up substantially in after-hours trading thanks to its earnings numbers and a solid future plan.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Netflix’s co-founder, Reed Hastings, announced that he would step down as Netflix’s co-CEO and instead become executive chairman. However, those investors hoping they could stop paying two CEOs were disappointed as Hastings named a new successor in Greg Peters. Peters was behind the rollout of the ad-supported tier and was also the chief operating officer. The company’s earnings numbers were quite mixed, with subscriber numbers wildly ahead of expected figures but net profit coming out much lower than last year.

The upside to that is that Netflix is now past the part where it will spend the most money. Now, it can focus on getting cash flow coming back into its operations. The new ad-supported tier and a strong crackdown on account sharing are the two strongest points in that plan. Even though Netflix admits such a plan could cause some short-term trouble, Netflix warned shareholders about “a very different quarterly paid net adds pattern” in the year to come.

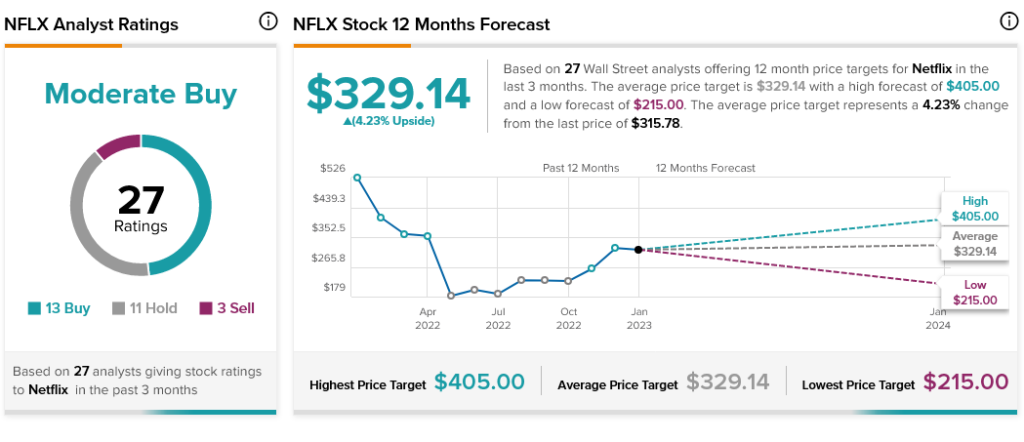

Overall, analyst consensus currently calls Netflix stock a Moderate Buy. Further, with an average price target of $329.14 per share, Netflix stock also enjoys 4.23% upside potential.