Streaming giant and FAANG stock Netflix (NASDAQ:NFLX) had a plan not so long ago to perk up its profits, which was simple enough: get the people who were sharing passwords to buy their own subscriptions instead. It was worthwhile and largely reasonable. However, a new study from Jefferies showed why it might be a bad idea.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Jefferies study took 380 so-called “password borrowers”—people who are watching Netflix via some other account—and discovered something disastrous. Of those 380, 62% of them would stop using Netflix altogether if they were prompted to get a new password. As for reasons, a full quarter of the group cited high costs, while 31% noted they didn’t like the content that much. The biggest portion, 35%, revealed that they can just replace Netflix with a different service. There are, indeed, plenty of potential services from which to choose.

Given that a 2022 Leichtman Research Group study found that around one in three Netflix subscribers is sharing a password, that’s a lot of potential users lost altogether. Ad-supported tiers did seem to help, but only in a limited way; the study found 40% of respondents would consider the ad-supported plan as a response. Still, it’s clear that Netflix’s password-sharing crackdown will cost the company some business and send consumers into the waiting arms of competitors.

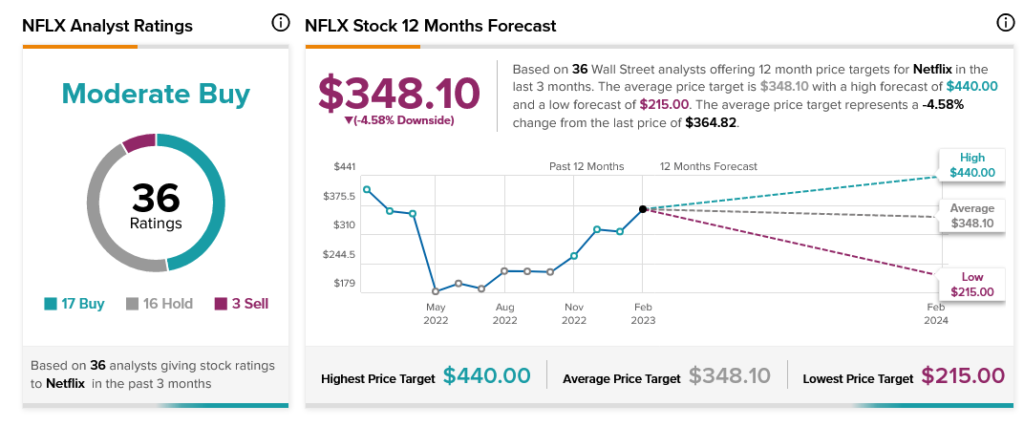

Wall Street, meanwhile, is sticking with Netflix as analyst consensus calls it a Moderate Buy. However, with an average price target of $348.10 per share, Netflix stock comes with 4.58% downside risk.