Shares of streaming giant Netflix (NFLX) gained in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at $6.61, which beat analysts’ consensus estimate of $5.67 per share. Sales increased by 12.5% year-over-year, with revenue hitting $10.54 billion. This also beat analysts’ expectations of $10.5 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

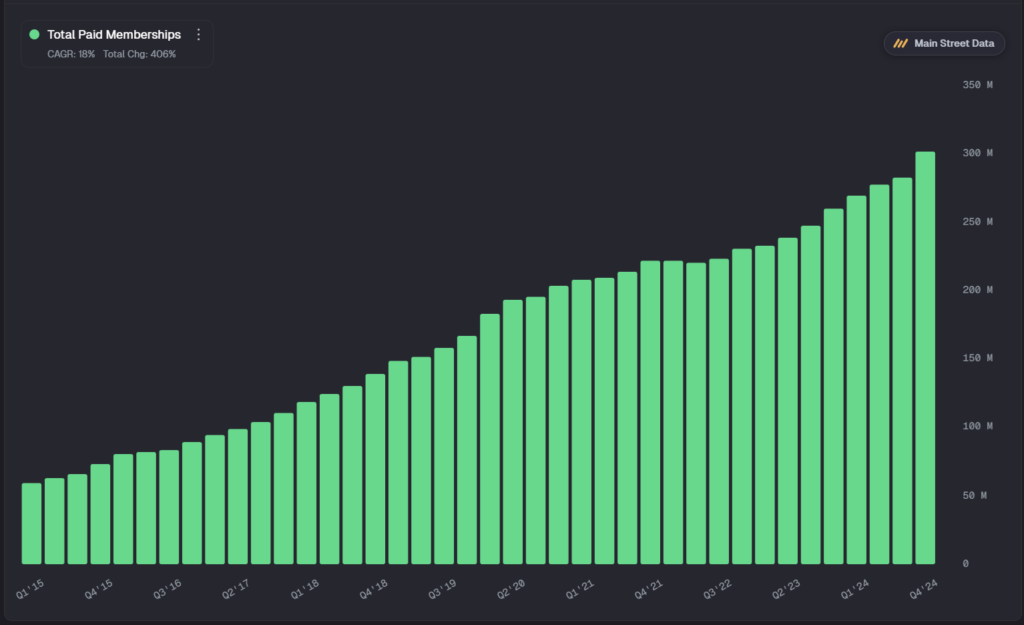

Although Netflix does not provide membership numbers anymore, we can see from the chart below, which is provided by Main Street Data, that Netflix’s paid memberships have been consistently growing over the past 10 years at a CAGR of 18% during this timeframe, resulting in a five-fold increase. Nevertheless, with today’s results, it seems safe to say that the number of subscribers has increased and remains above 300 million.

Unsurprisingly, this subscriber growth has led to an overall increase in operating income and margin during this period, as it has allowed the company to achieve operating leverage through predictable and recurring revenue. This has also allowed Netflix to lower its marketing costs as a percentage of revenue to a more sustainable range of 6% to 10%, versus its peak of 17.4%, as represented below by the green point in Q4 2018. More importantly, operating income for the current quarter jumped by 27% to $3.3B, while operating margin was 32% versus the 28% seen in Q1 2024.

Netflix’s Guidance for Q2 2025

Looking forward, management has provided the following guidance for Q2 2025:

- Revenue growth of 15% versus analysts’ estimates of 3.8%

- Non-GAAP operating margin of 33%

The growth in revenue is expected to come from recent price changes, along with the continued growth in memberships and advertising revenue. As we can see, the company’s outlook is better than expected, which, when combined with the earnings and revenue beats, led to the after-hours move in the stock price.

Is NFLX Stock a Good Buy?

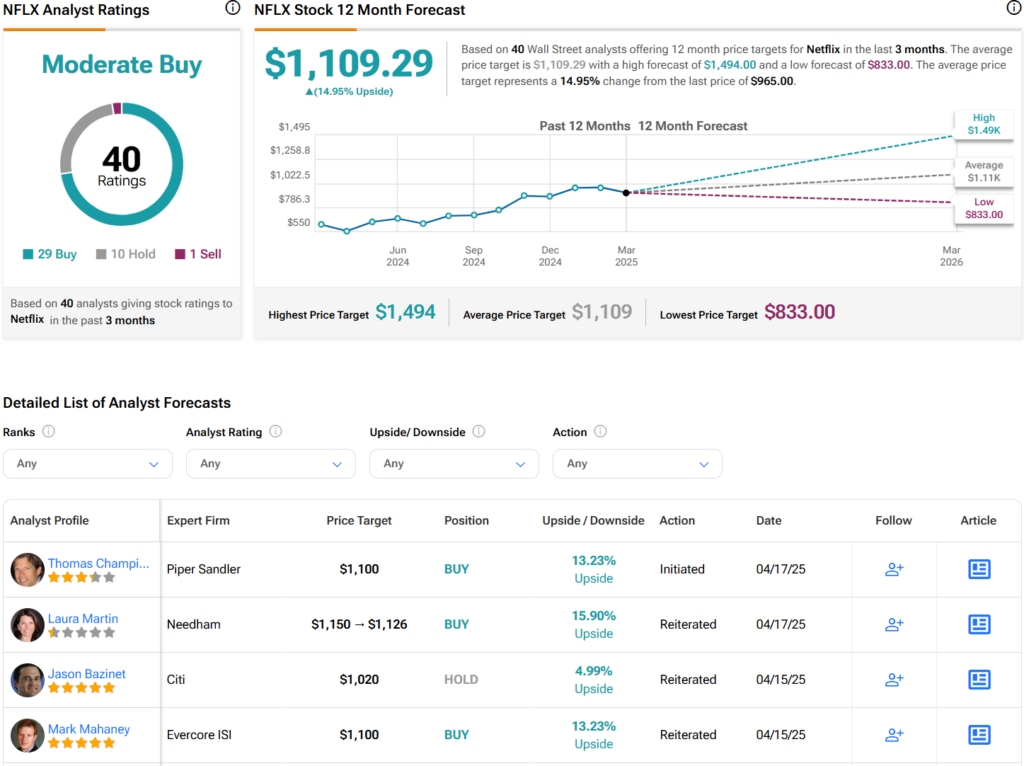

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 29 Buys, 10 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NFLX price target of $1,109.29 per share implies 15% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.