Few things are scarier to investors than forecast cuts. Energy stock Nextera Energy Partners (NYSE:NEP) found this out after an unfortunate announcement sent shares on a downward spiral in Thursday’s trading session, falling as much as 17% at one point.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The plunge for Nextera began when it cut its forecasts, adjusting its earnings before interest, taxes, depreciation, and amortization (EBITDA) downward and also cutting its expected growth rate for partner distributions as well. Several analysts responded by cutting their outlooks, with both Oppenheimer and JPMorgan slashing their ratings from Buy to Hold. More specifically, Mark Strouse with JPMorgan noted that Nextera was suffering from a “vicious spiral” that featured capital costs going up, limiting growth, and making capital that much harder to come by to spend on the rising costs, limiting growth still further.

Several analysts did leave their Buy ratings in place, however, including Raymond James, Wolfe Research, and Mizuho Securities’ Anthony Crowdell. This is despite a drop in growth forecasts from its original 8% to a new 5% through at least 2026, though Nextera is hoping to get that number ultimately up to 6%. That’s still only about half of what was originally anticipated and likely left a bad taste in investors’ mouths, prompting the mass exodus. There are some potentially positive signs, as Noah Kaye at Oppenheimer pointed out, but even this will require Nextera to “…execute on accretive growth, key divestitures and 2024-25 debt refinancing.”

What is Going On with Nextera Energy?

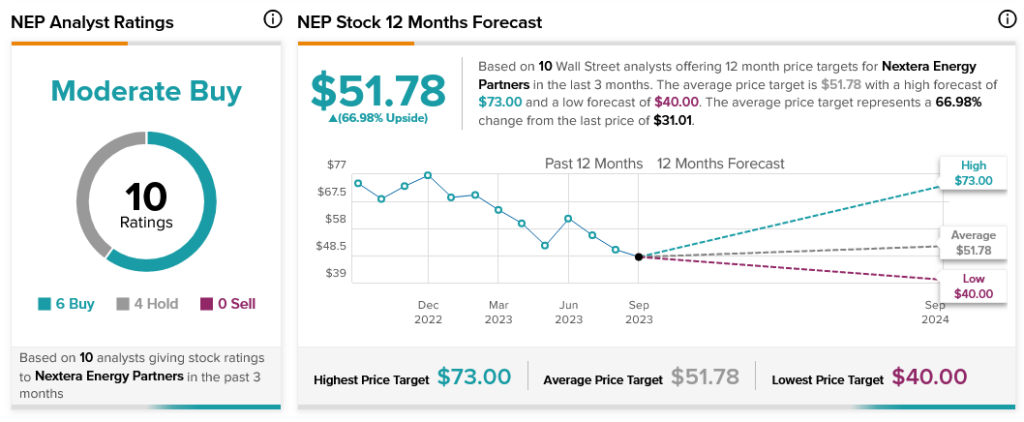

Despite all this, analyst consensus is still on Nextera’s side. Nextera Energy Partners stock is rated a Moderate Buy by consensus, with six Buy ratings against four Holds. Further, with an average price target of $51.78, Nextera Energy Partners stock boasts 66.98% upside potential.