Nvidia (NASDAQ:NVDA) stock has had a bumpy ride in 2025, shaken by trade-related turbulence, export restrictions, and broad market uncertainty. But the skies are starting to clear for the AI giant, and its shares have responded accordingly – climbing 35% since the April 8 low.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A few factors have combined to shift the narrative surrounding Nvidia, including a reaffirmation of AI capex spending by hyperscalers, strong demand for Nvidia’s Blackwell chips, and easing trade tensions between the U.S. and China.

However, the road ahead isn’t entirely smooth. With Q1 FY 2026 earnings due later this month, Nvidia has already warned investors of a $5.5 billion revenue hit tied to the Trump administration’s crackdown on H20 chip exports to China.

Even so, not everyone’s sweating it. One investor, known by the pseudonym Deep Value Investing, sees this as a golden opportunity, arguing that Nvidia is well-positioned to beat Q1 estimates and that now might be an ideal time to load up on shares.

“The company is still undervalued when compared to its historical performance and to its closest peers,” asserts Deep Value.

According to the investor Nvidia’s H20 chips raked in an estimated $12 billion in 2024, even though many were sold at discounted prices. Deep Value believes the real culprit behind Nvidia’s recent margin pressure isn’t the Blackwell rollout, as some suspect, but rather the sharp decline in sales to China.

“The less revenue exposure to this country, the higher the margins,” notes the investor, who points out that Nvidia has recently announced a downgraded version of the H20 designed for the Chinese market.

When it comes to the larger tariff question, Deep Value is not too concerned here either. The investor predicts that tariffs will settle at the 25% level, and Nvidia should be able to pass along much of these cost increases to their customers.

Summing up, Deep Value posits that the overall dip in 2025 has created a great buying point. The investor expects that NVDA will surge back up to $150 by the end of 2025.

“The drama is over,” declares Deep Value Investing, rating NVDA shares a Strong Buy. (To watch Deep Value Investing’s track record, click here)

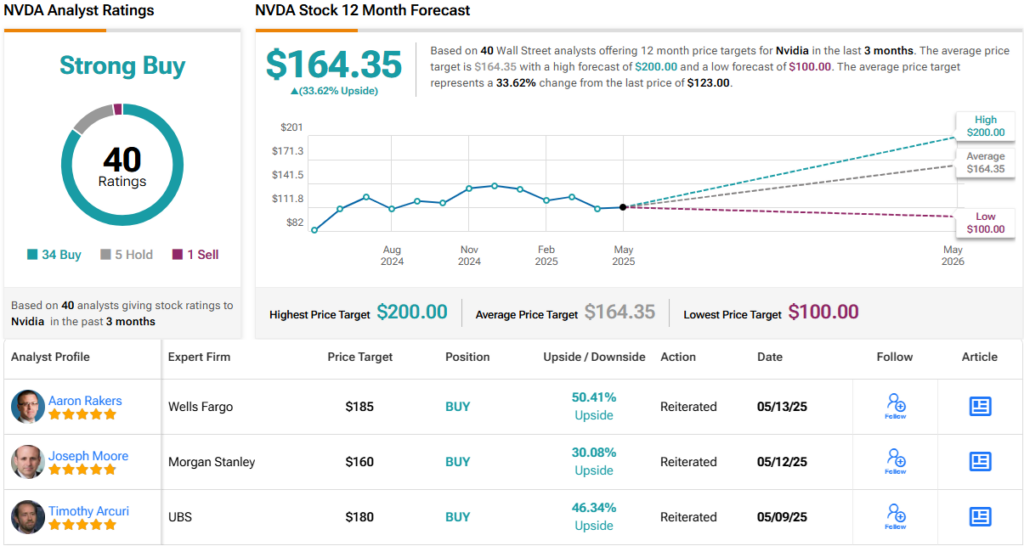

There is hardly any dissent over on Wall Street. With 34 Buy, 5 Hold, and 1 Sell recommendations, NVDA boasts a Strong Buy consensus rating. Its 12-month average price target of $164.35 implies a ~34% upside potential from current levels. (See NVDA stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.