On Tuesday, zinc producer Nexa Resources (NYSE:NEXA) announced that it has paused production at its Atacocha San Gerardo open pit mine, following local protests.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Machcan community’s protest activities have led to illegal road blockages due to which production at full capacity had to be temporarily suspended. Activities at the mine will be limited to critical maintenance operations utilizing a minimal workforce.

The protests have been long-drawn, and operations were suspended temporarily in March 2022 as well. Disputes have been wide-ranging, including property titles, interactions between communities and mines about demands regarding payouts and other issues, and unsolved political promises.

The Atacocha mine, which produces about 200,000 tons of zinc per week, accounts for less than 3% of Nexa’s total weekly zinc production.

“Nexa is complying with all existing agreements, pursuing an active dialogue with the community and authorities for a peaceful resolution of this situation, in addition to remaining committed to the social development of all its host communities,” the company said in a statement.

What is the Market Cap of NEXA?

As of January 3, 2023, Nexa’s market capitalization is $798.6 million. Shares of the company have shed 28.2% in the past year.

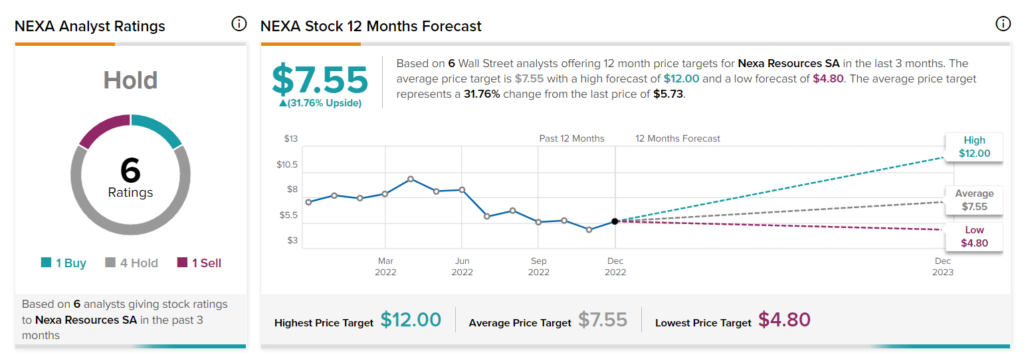

Wall Street is cautious about the stock, with a Hold consensus rating based on one Buy, four Holds, and one Sell. The average price target of $7.55 indicates a 31.76% rise in the next 12 months.