Class A shares of News Corp. (NASDAQ:NWSA) spiked 3.4% initially in the extended trading session after reporting a Q4 earnings beat. However, shares lost momentum and slipped 2.3% later after the company announced its artificial intelligence (AI) ambitions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

News Corp. CEO Robert Thomson said that AI presents a “remarkable opportunity” as a new revenue stream. The company is in active negotiations to monetize its “unique content sets and IP” as AI takes center stage in different areas of business.

News Corp. has not remained immune to the overall downturn in print media and book publishing businesses worldwide. The company is facing high subscriber churn and lower advertising revenues in its media unit while its digital streams continue to gain strength. Further, the Digital Real Estate businesses in the U.S. and Australia saw a significant downfall owing to the difficult housing market conditions. NWSA stock has gained 11.7% so far in 2023.

News Corp.’s Q4FY23 Results in Detail

The media conglomerate posted Q4 adjusted earnings of $0.14 per share, easily surpassing the consensus of $0.09 per share. Even so, the figure came in much lower than the comparative prior-year figure of $0.37 per share.

On the other hand, quarterly revenue of $2.43 billion fell 9% year-over-year and also missed the Street’s estimates of $2.49 billion. The decline was attributed to a 17% decline in Digital Real Estate Services and a 13% fall in News Corp.’s Book Publishing segment revenues. Meanwhile, revenues from the Subscription Video Services segment fell 4%, Dow Jones declined 3%, and the News Media segment fell 9% compared to the prior-year period. The main hit to revenue was also because of one less week in the current quarter compared to FY22 and the impact of foreign currency translation.

Compared to Q4FY22, total subscriptions at Dow Jones’ The Wall Street Journal unit grew 6%, Barron’s Group jumped 13%, and Total Consumer rose 7%.

Full Year Fiscal 2023 Results

For the full year of Fiscal 2023, NWSA reported revenues of $9.88 billion, down 5% annually owing to the same reasons for a drop in quarterly revenues. Also, adjusted earnings came in at $0.49 per share, far lower than the FY22 figure of $1.20 per share.

Dow Jones has been a winner for News Corp. the only segment to report an increase (7%) in annual revenues and recording its highest profitability in both Q4 and FY23. The company noted that, for the first time, digital revenues contributed more than 50% of total revenues.

Based on the momentum in the second half of the year, the company remains optimistic about the coming quarters’ performance thanks to “inflation abating, interest rates plateauing, and incipient signs of stability in the housing market.”

What is News Corp.’s Price Target?

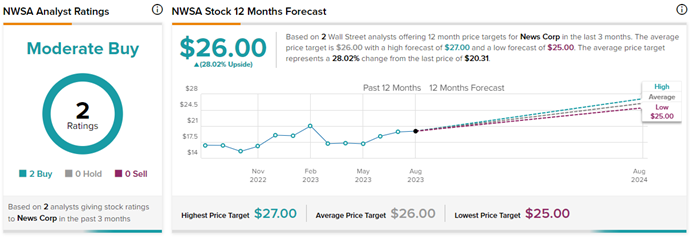

On TipRanks, the average News Corp. Class A price target is $26, which implies 28% upside potential from current levels. The stock has a Moderate Buy consensus rating based on two Buy ratings in the past three months before the year-end results were announced.