Gold miner Newmont (NYSE:NEM) has reached an agreement with the National Union of Mine, Metal, and Allied Workers of the Mexican Republic to put an end to a strike at its Penasquito mine in Zacatecas state.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The agreement puts an end to the nearly four-month strike. While the Union had sought additional profit sharing, Newmont will not pay any additional incremental profit share for 2022.

The company will pay nearly 60% of the lost wages to employees since the beginning of the strike in early June, and if the mine ekes out no profit in 2023, then Newmont will pay an additional bonus to employees next year. Under separate negotiations, Newmont has also agreed to an 8% wage increase for employees.

The company expects that achieving stable production at the mine will take several weeks, and more details are anticipated during its third-quarter results on October 26. Analysts expect Newmont to generate an EPS of $0.47 on revenue of $2.9 billion for the quarter. The company had posted an EPS of $0.27, missing expectations by nearly $0.09, in the year-ago period.

Is Newmont a Buy, Sell, or a Hold?

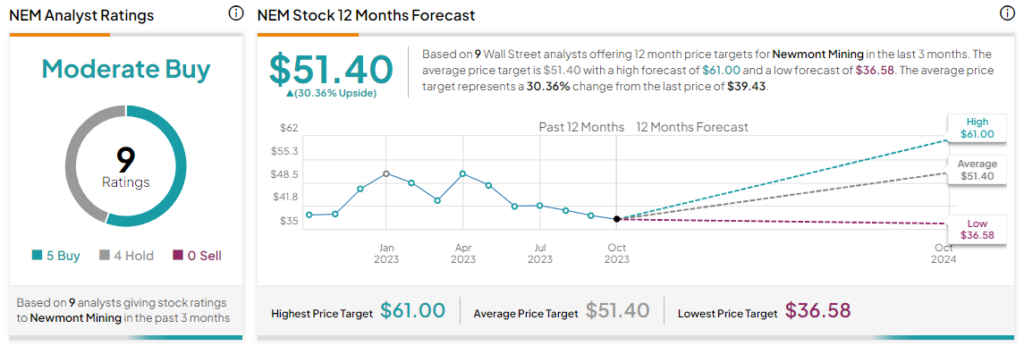

Overall, the Street has a Moderate Buy consensus rating on Newmont. The average NEM price target of $51.40 implies a substantial 30.4% potential upside.

Read full Disclosure