Shares of consumer goods provider Newell Brands (NASDAQ:NWL) are trending lower at the time of writing after the company announced third-quarter results. Revenue declined by 9.3% year-over-year to $2.04 billion, missing expectations by $80 million. EPS of $0.39, however, handily surpassed estimates by $0.16.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, the company witnessed a sales decline across all of its segments. Core sales in its Home & Commercial Solutions segment dropped by 7.1%, primarily due to weakness in the kitchen, home fragrance, and commercial categories. Additionally, net sales in the Outdoor & Recreation segment plummeted by 20.9%.

Despite the sales challenges, NWL’s gross margin improved by 110 basis points to 30.3%. The company has increased its operating cash flow by over $1.2 billion and lowered its debt by nearly $400 million so far this year. With a continued focus on operational execution, gross margins are expected to continue to improve in the fourth quarter.

For Fiscal Year 2023, NWL expects net sales to hover in the range of $8.02 billion to $8.09 billion. In addition, EPS for the year is anticipated to land between $0.72 and $0.77.

Is NWL Stock a Good Buy?

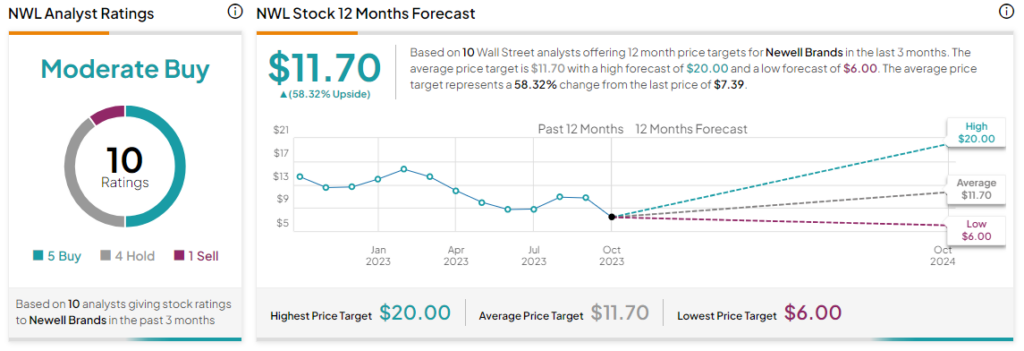

Overall, the Street has a Moderate Buy consensus rating on Newell Brands. The average NWL price target of $11.70 implies a hefty 58.3% potential upside. That’s after a nearly 53% slide in the company’s shares over the past year.

Read full Disclosure