New Zealand is gearing up to enact groundbreaking legislation aimed at imposing a digital services tax on major multinational companies like Meta Platforms (META) and Google (GOOGL), according to a Bloomberg report. While the proposed tax is unlikely to be implemented until 2025, the move underscores the country’s determination to ensure tech giants contribute their fair share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The country’s Finance Minister Grant Robertson revealed that the proposed tax would target multinational firms earning over €750 million ($810 million) globally from digital services and over NZ$3.5 million ($2 million) annually from services offered to New Zealand users. The tax would be applied at a rate of 3% on gross taxable digital services revenue in New Zealand and is similar to a tax in countries like the UK and France. Robertson anticipates that it will generate approximately NZ$222 million over a span of four years.

New Zealand is applying this tax as the country believes that tech behemoths like Google and Facebook don’t pay enough tax as they exploit the complexities of international regulations. As Robertson pointed out, “With more and more overseas businesses embracing digital business models, our ability to tax them is restricted and the burden falls to smaller groups of taxpayers.”

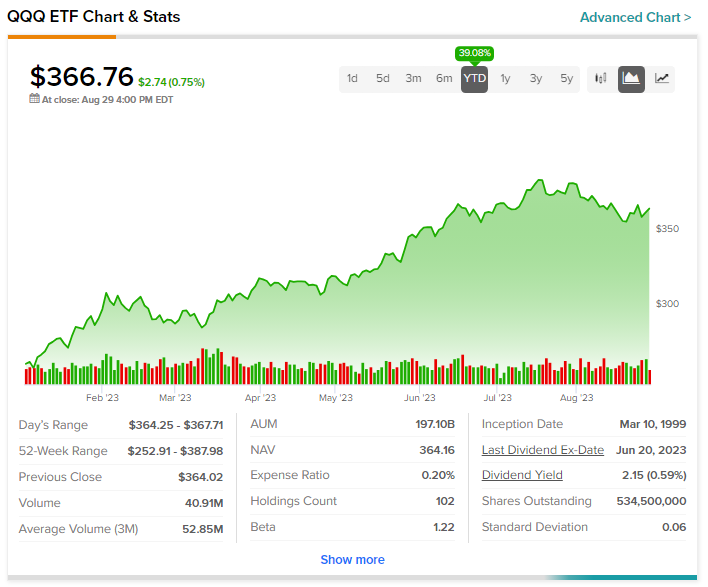

The concerns over digital tax aside, for investors interested in getting exposure to the tech sector, the Invesco QQQ Trust (QQQ) offers a good option. QQQ ETF has soared by more than 35% year-to-date.