In a sign of escalating geopolitical conflict between the U.S. and China, the U.S. government announced steep tariffs on Chinese imports to protect key U.S. industries from China’s overproduction. According to an exclusive Reuters report, a U.S. Trade Representative (USTR) stated that, effective from September 27, a 100% duty on Chinese electric vehicles (EVs) will be imposed, along with 50% tariffs on solar cells and 25% on steel, aluminum, and EV batteries.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moreover, the report highlights that a 50% import duty will be imposed on Chinese semiconductors effective from next year. Furthermore, the China-made chips are divided into two categories: polysilicon used in solar panels and silicon wafers.

U.S. Has Imposed Tariffs on Key EV Components

Despite industry concerns, particularly about the need for critical EV minerals like graphite, the administration has maintained high tariffs to reduce its dependence on China. As a result, USTR has left unchanged a tariff of 25% on lithium-ion batteries, minerals, and components.

In fact, U.S. Trade Representative Lael Brainard told Reuters that these “tough, targeted” tariffs were necessary to counter China’s state-driven subsidies, which have led to excess production capacity in various sectors, particularly EVs.

Meanwhile, some exceptions to the hike in tariffs were granted to U.S. port operators on ship-to-shore cranes and medical supplies. However, even as the USTR increased tariffs on medical face masks and surgical gloves to 50%, up from the initially proposed 25%, it delayed the start to allow a transition to non-Chinese suppliers.

Steep Tariffs Imposed Amid Election Year in the U.S.

The news of the steep hike in tariffs comes as both Presidential candidates, Vice President Kamala Harris and former President Donald Trump, are positioning themselves as being tough on China ahead of the U.S. election later this year. This is because both Presidential candidates are trying to woo voters in the automobile manufacturing and steel-producing states, with Trump proposing 60% tariffs on all Chinese imports.

Global Tariffs Threaten Chinese EV Market Share

As a sign of increasing trouble for China, and Chinese EV companies in particular, the European Union and Canada have also announced similar tariffs on Chinese EVs. These new tariffs reflect a strong U.S. stance aimed at reducing reliance on Chinese manufacturing and could significantly impact the market share of Chinese EV companies like Li (LI), NIO (NIO), and XPeng (XPEV).

Are EV Stocks a Buy?

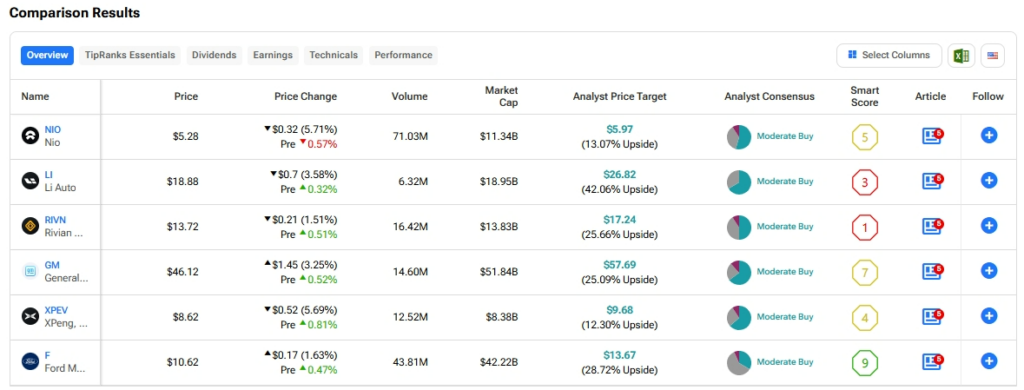

We used TipRanks’ Stock Comparison tool for Best EV stocks and filtered stocks that have earned a Strong Buy or Moderate Buy consensus rating from Wall Street analysts. Based on the results below, these are the best EV stocks to buy, according to analysts.