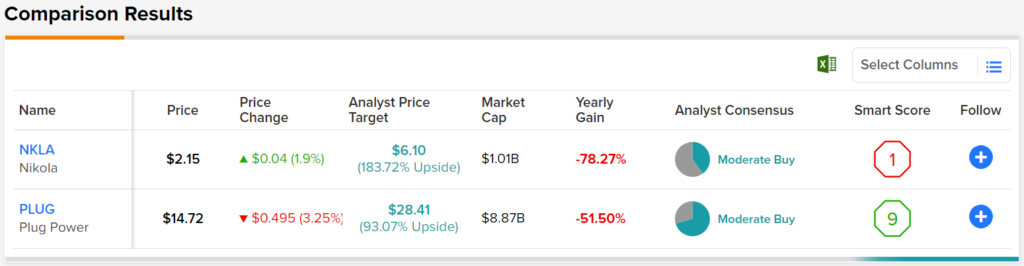

On the surface, the latest move between electric vehicle maker Nikola (NASDAQ:NKLA) and hydrogen fuel cell company Plug Power (NASDAQ:PLUG) should be a perfect match. Yet the market responded only favorably to Nikola, sending it up slightly in Thursday afternoon trading. Meanwhile, Plug Power’s Thursday afternoon featured a significant decline.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The move featured Plug Power agreeing to step up its green hydrogen production to Nikola. Plug power will offer as much as 125 tons per day. Plug Power’s production network is still something of a work in progress at last report. Thus, it may take some time to reach those levels.

Meanwhile, Nikola agreed to pick up a new 30-tons-per-day (TPD) hydrogen liquefaction system. Said system will help kick off the first phase of Nikola’s hydrogen operations in Arizona. In turn, Plug agreed to buy 75 hydrogen-powered trucks from Nikola and will take delivery over the course of the next three years.

The move will give Nikola access to a big new source of hydrogen and hydrogen generation. Meanwhile, Plug will be able to reduce its own carbon footprint in turn. Plug intends to use the trucks with their line of hydrogen tankers. Said tankers are reportedly both the largest and lightest trailers ever manufactured. Nikola’s purchase will ultimately account for a major share of Plug’s generation capabilities, as Plug expects to produce 500 TPD by 2028.

Nikola landed some of the biggest benefits. However, analyst perspective is currently mixed. Consensus opinion considers Nikola a Moderate Buy. Thanks to its average price target of $6.10, it has an upside potential of 183.72%. Plug Power, meanwhile, is also considered a Moderate Buy. It offers a 93.07% upside potential with an average price target of $28.41.