It’s not always the case, but usually, a stock hit as hard as biotech stock TG Therapeutics (NASDAQ:TGTX) has a reason behind it. In Friday afternoon’s trading, that proved to be just the case, thanks to the latest release of sales data around one of TG’s flagship drugs. TG Therapeutics fell over 5% on that news.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cantor Fitzgerald, not so long ago, started tracking sales data on Briumvi, a multiple sclerosis treatment drug that is one of the leading names in TG’s arsenal. On the plus side, sales were on the way up. Based on data from Symphony Health, Cantor Fitzgerald—via analyst Prakhar Agrawal—noted that Briumvi sales hit $7.2 million. That’s up substantially from the July sales figure of $5.9 million and puts TG Therapeutics on a good upward-looking track.

However, with consensus sales estimates of $27 million, TG basically needs to post sales similar to both July and August combined in order to match analyst projections. And there’s another problem waiting in the wings: Roche. Roche is getting its own multiple sclerosis drug ready: Ocrevus. Rather, an under-the-skin version that could put Briumvi in a bind and do likewise for TG Therapeutics. And with signs that insiders are abandoning ship, that could mean some trouble ahead.

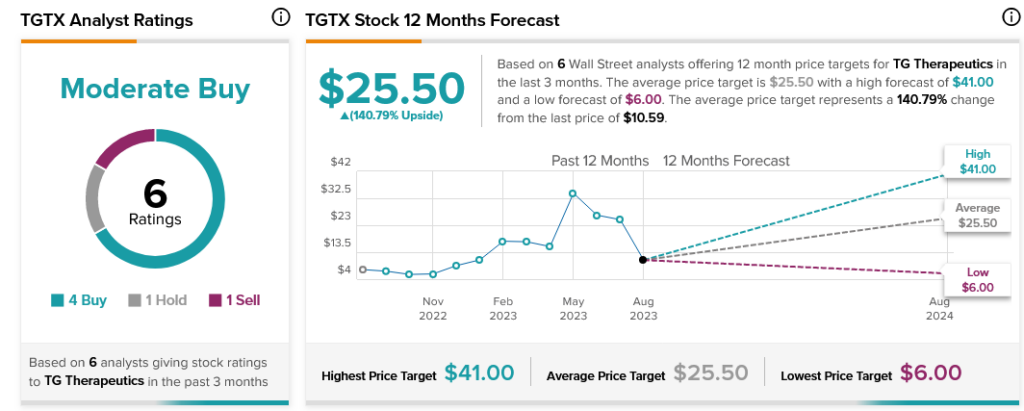

Analysts, meanwhile, are largely on TG Therapeutics’ side. Currently, TG Therapeutics stock is considered a Moderate Buy, with four Buy ratings, one Hold, and one Sell. Further, TG Therapeutics stock offers investors a staggering 140.79% upside potential thanks to its average price target of $25.50.