While Moore’s Law has been a shockingly apt description of the processor development landscape for some time now—processing power doubles roughly every 18 months—it’s started to look a bit threadbare. And with good reason, Moore’s Law was coined back in the 1960s, after all. But with a roadblock coming up in the form of sheer physics, the move is on to reach quantum computing. Chip manufacturer Intel (NASDAQ:INTC) recently made a significant advance in that sector, and investors rewarded it accordingly, sending share prices up nearly 1.5% in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move in question came out with a new research paper from Intel titled “Probing single electrons across 300-mm spin qubit wafers.” That may sound like a huge pile of gibberish, but it’s actually an important part of building reliable, scalable quantum computers. In fact, this could be the founding piece of mass-produced quantum processors, which will be vital for building the first quantum computer.

And on the Production Side…

Intel’s potential advance into quantum computing is a big deal, but it’s not all Intel had to show off. It also offered up a new video look at the Ohio One campus in New Albany, a structure that will set Intel back a whopping $28 billion when complete. It will take a few years to complete, but when it’s ready, it will offer some impressive benefits for local wildlife, like wetlands and pollinator plants, as well as a pair of factories to help drive production. That combination of ecological awareness for good press and expanded production should help drive new interest and sales for Intel in the years ahead.

Is Intel a Good Stock to Buy?

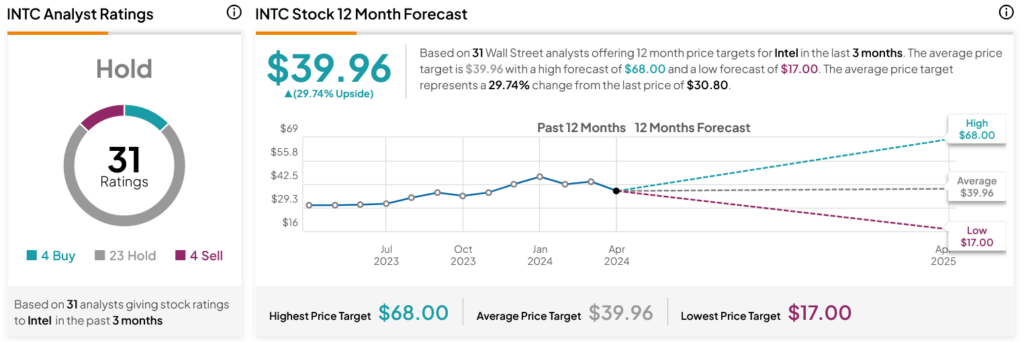

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on four Buys, 23 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 5.31% rally in its share price over the past year, the average INTC price target of $39.96 per share implies 29.74% upside potential.