Good news and bad news for Intel (NASDAQ:INTC) buffs and investors today, as the chip maker revealed a slate of new graphics processing units (GPUs) coming up for release. However, the new processors won’t be around for a while, at least not to the average user. Still, Intel’s clever marketing ploy here was enough for investors, who gave it a modest boost in share prices in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s been two years, reports note, since Intel rolled out anything in the Arc GPU line, with the Arc Alchemist making an appearance. However, that line just got an update today, with six new models coming to the Arc line. Still, there’s a bit of a downside to this launch, depending on who you are and what you’re planning to use these for.

The new Arc GPUs are intended for edge systems, or embedded systems, which means you probably won’t be slapping one of these in your desktop to get better gaming performance or mining cryptocurrency. However, the new edge-friendly systems are likely to have welcome applications, as edge systems are often used in things like autonomous driving systems, the Internet of Things (IoT), and artificial intelligence (AI).

Intel May Have Trouble on Its Hands with Lawmakers

Meanwhile, Intel may have more trouble on its hands with lawmakers. New reports suggest that the latest Huawei laptop is packing processors from Intel’s Meteor Lake lineup. The problem, however, is that those processors really shouldn’t have made it to Huawei, a Chinese company, in the first place, as China has been under trade restrictions since 2019.

However, an export license granted under the Trump Administration in 2019 gave Intel permission to work with Huawei, a development that has some in Washington fuming.

Is Intel a Buy, Hold, or Sell?

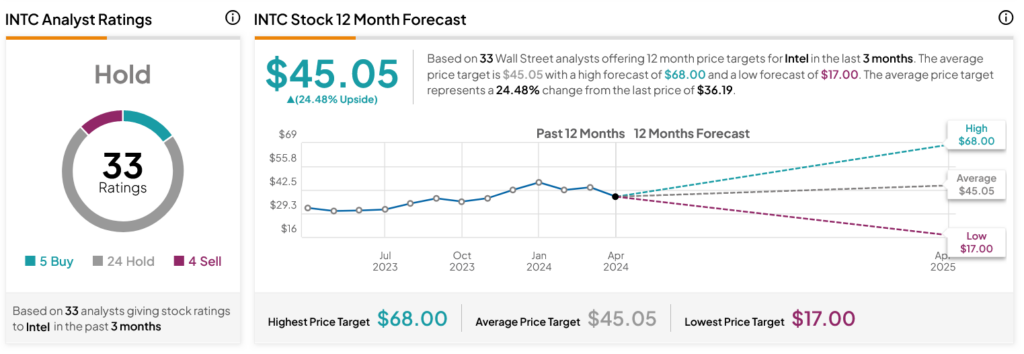

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on five Buys, 24 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 13.91% rally in its share price over the past year, the average INTC price target of $45.05 per share implies 24.48% upside potential.