Keeping up a drug pipeline is vital for a pharmaceutical stock like Novo Nordisk (NYSE:NVO), and the latest move it planned should have been seen as a way to help cement said pipeline. But its plan to shell out big money—nine-figure big—to pick up a hypertension drug isn’t sitting well with investors. In fact, Novo Nordisk lost modestly in Monday afternoon’s trading as a result.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Novo Nordisk announced that it will pay as much as $1.3 billion to pick up a new drug that will treat hypertension in patients with chronic kidney disease known as ocedurenone. Ocedurenone, a KBP Biosciences product, is an orally administered drug that’s currently in Phase 3 testing, which means it’s likely to make an appearance in markets before too much longer. Novo Nordisk plans to pay for the drug out of its cash reserves, which may not have sat well with investors.

The move now lets Novo Nordisk directly challenge Bayer, who holds a major part of the market with its drug Karendia. While some might question just how much Novo Nordisk shelled out for this, it’s not exactly cash-poor right now. With semaglutide shares on the rise and Novo Nordisk hiking its sales outlook, Novo Nordisk using its cash to buy other business’ developments instead of making its own is a viable strategy. Novo Nordisk is, after all, the company behind Ozempic, which is enjoying a golden age right now as people flock to the weight-loss drug.

Is Novo Nordisk a Buy, Sell, or Hold?

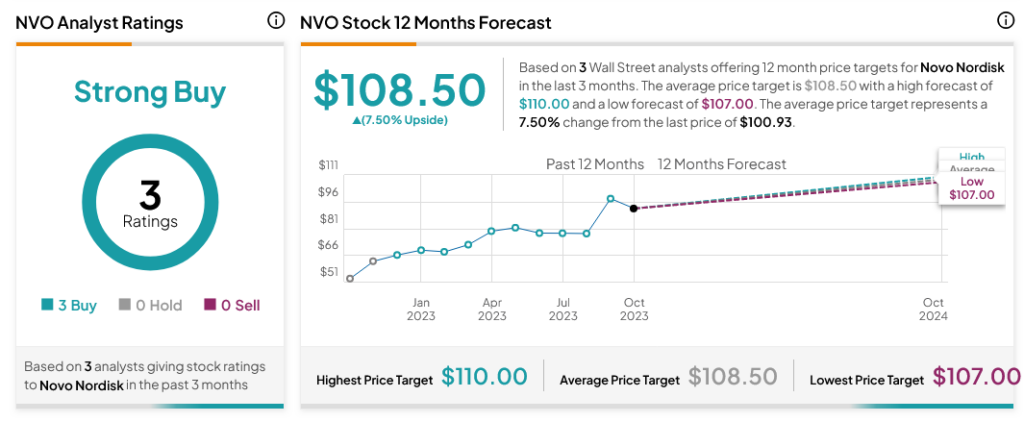

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVO stock based on three Buys assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVO price target of $108.50 per share implies 7.5% upside potential.