Affirm Holdings (NASDAQ:AFRM) was already a major figure in shopping thanks to its advances in buy now pay later (BNPL) technology. With BNPL use surging this holiday shopping season, it might not be too surprising to hear other businesses are turning to the service. In fact, Affirm is up over 16% in Tuesday afternoon’s trading thanks to a major new partnership with Walmart (NYSE:WMT).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Yes, Walmart shoppers will now be able to use Affirm’s BNPL services right from the checkout counter. That’s over 4,500 new locations and a vast increase in market depth for Affirm. While this partnership isn’t completely new—Walmart and Affirm have worked together in the past—the previous partnerships extended a kind of membership by letting customers apply for credit and then show a barcode to access the multi-payment deal plan. Now, the option will be available to all right from checkout.

This Move Comes at Just the Right Time for Affirm

This move comes at just the right time for Affirm, though it might have been better to see it two weeks ago rather than just as the holiday shopping season is about to conclude for another year. With customers increasingly feeling pinched by out-of-control inflation and concerns about the job market, the option to break down large payments into several smaller payments is proving increasingly attractive. That’s opening up the field for Affirm and allowing it to branch out further. Indeed, Affirm stock is already up 70% just over the last month as more and more customers catch on to what it has to offer.

Is Affirm a Buy or Hold?

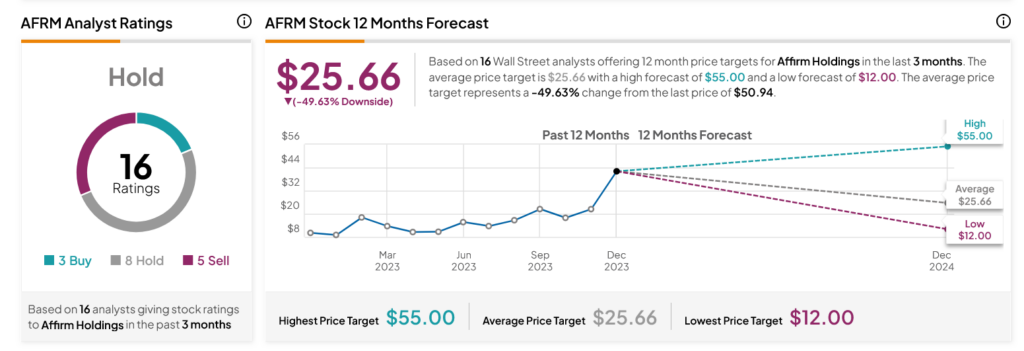

Turning to Wall Street, analysts have a Hold consensus rating on AFRM stock based on three Buys, eight Holds, and five Sells assigned in the past three months, as indicated by the graphic below. After a 436.65% rally in its share price over the past year, the average AFRM price target of $25.66 per share implies 49.63% downside risk.