Apple (NASDAQ:AAPL) users that picked up iPhone 14 models, and enjoyed the Emergency SOS satellite-based service, will likely be happy to know that they’ll have more of it to like soon. Investors were surprisingly happy about the news as well, giving Apple a fractional boost in Wednesday afternoon’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Emergency SOS system is a terrific play for those iPhone users who occasionally find themselves roaming so far off the beaten path that they no longer have service of any stripe. When you can’t call, when you can’t connect to mobile data, and something goes wrong, what’s left? That’s where Emergency SOS kicks in, and iPhone 14 users got free time with the service previously. Now, Apple is extending that access out another year, for those who activated their devices in eligible locations before November 15.

A Clear Popularity Play

The big reason behind the move, based on reports from Apple, is that Emergency SOS has already saved lives. Having such a tool on hand, whether or not it’s actually used, likely serves as a welcome backup plan for Apple device users.

Meanwhile, Apple is also working to upgrade its iPads; reports suggest that Apple has plans to bring OLED screens to its iPad lineup before putting them in place on their laptops. That’s still something of an early-stage report, and it might change before it’s all said and done, but already, some Apple users are coming out in favor of the move. The biggest reason is that an OLED screen would provide more of a field of vision; an LCD display loses clarity the farther off-center you go when looking at it. And an OLED, thus, might bring more users back to the iPad line.

Is Apple a Buy, Sell, or Hold?

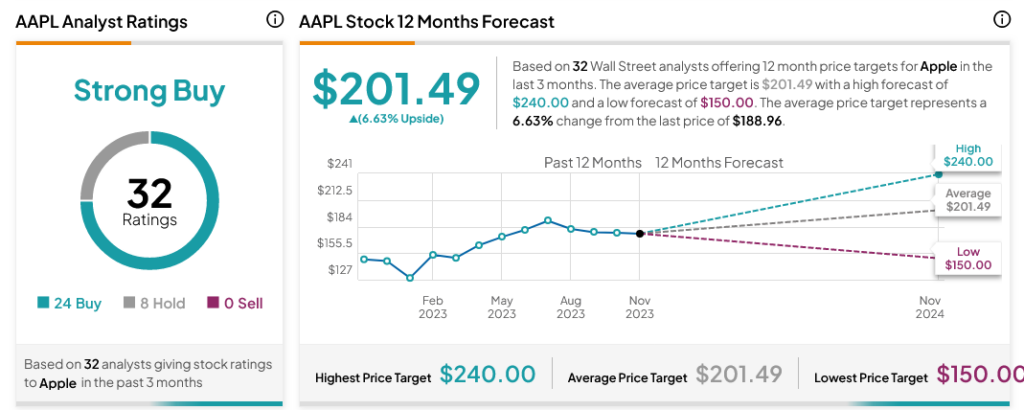

Turning to Wall Street, analysts have a Strong Buy consensus rating on AAPL stock based on 24 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 27.72% rally in its share price over the past year, the average AAPL price target of $201.49 per share implies 6.63% upside potential.