Aerospace giant Boeing (NYSE:BA) had a pretty big day, with a whole bundle of new technological firsts on its plate. Investors, however, were not impressed about the growing string of big new firsts at Boeing, and sent shares down nearly 2% in Thursday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Boeing, backed up by NASA and United Airlines (NASDAQ:UAL), is currently working on the next generation of aviation fuel, which is up to the in-flight testing stage. The testing will focus on several key components, including levels of non-carbon emissions, the contents of contrails, and any potential impact on climate. Boeing put together a special aircraft just for the testing, known as the ecoDemonstrator Explorer. It’s the second such craft Boeing assembled, and can fly with standard jet fuel and the new sustainable fuel in separate tanks.

That’s not all, either; Boeing recently started flying a brand new Apache AH-64E attack helicopter, complete with a string of new capabilities. Word from DefenseNews notes that the new Apache comes with a string of software updates for flight computers as well as some direct improvement to pilot controls and interface mechanisms. This is version 6.5 of the Apache AH-64E, reports note, and will ultimately boast Link 16 systems as well as better route and attack planning tools.

Is BA a Good Buy Right Now?

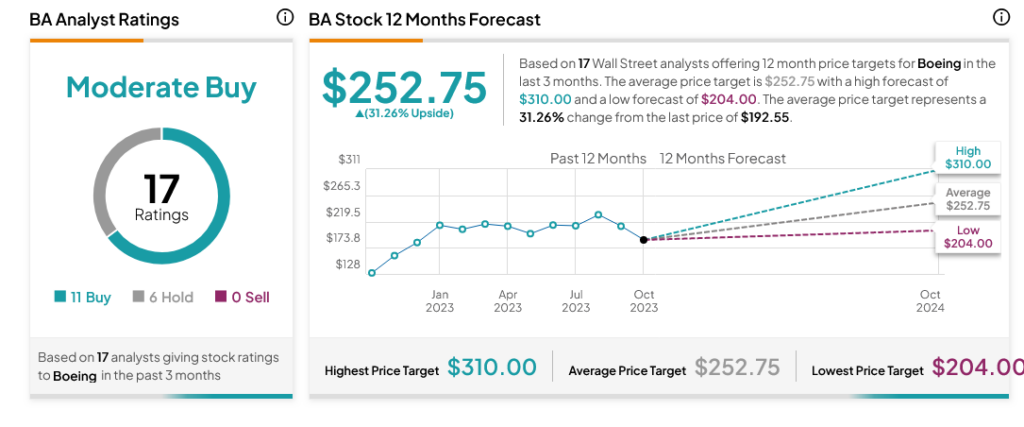

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 11 Buys and six Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average BA price target of $252.75 per share implies 31.26% upside potential.