Normally, when analysts say good things about a stock, it helps that stock up, at least somewhat. Today turned that example on its head as electric vehicle stock ChargePoint Holdings (NASDAQ:CHPT) got some very positive press from one analyst but still fell nearly 8% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

RBC Capital Markets analysts Laura Deng and Chris Dendrinos brought out a note laden with praise for ChargePoint, noting that it offered a “…robust product portfolio” and supported it with a “…differentiated strategy and asset-light business model.” All of that together was enough for the duo to call ChargePoint an “outperform,” but that didn’t seem to matter much to investors.

That could have something to do with several possible factors, like the earnings report ChargePoint turned in on Wednesday. That featured not only a loss of $0.35 per share but also a larger loss than even the $0.21 per share that analysts expected. Revenue was up against this time last year by a healthy 39%, but even that was a miss against analyst projections. ChargePoint also cut a slew of jobs, but this offered little help, and some are even pointing to the overall macroeconomic picture as a reason that ChargePoint is losing out.

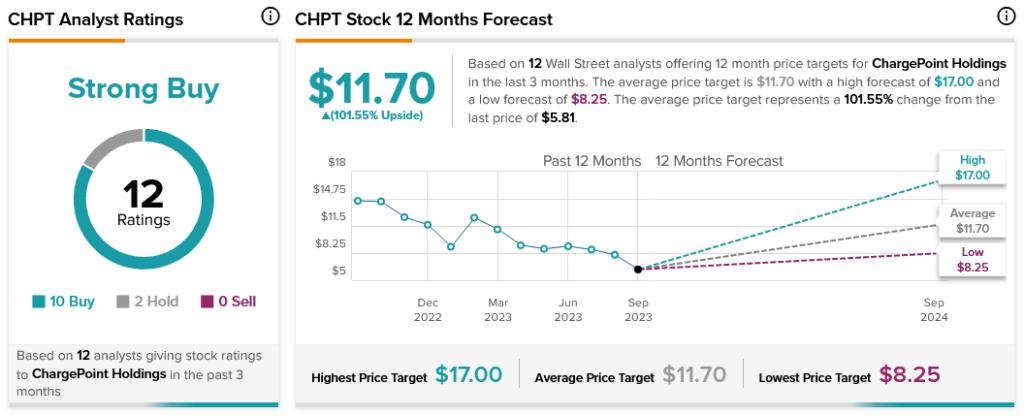

None of this is balking analysts much, however. A combination of 10 Buy ratings and two Holds puts ChargePoint Holdings stock at a Strong Buy. Meanwhile, ChargePoint Holdings stock offers investors a staggering upside potential of 101.55%, thanks to its average price target of $11.70.