Lately, media stocks haven’t been doing all that great. However, there are signs of a comeback emerging as Netflix (NASDAQ:NFLX) surged in Thursday’s trading, prompting a rush to pick up other media stocks. Netflix made a serious push toward 10% gains but gave some of those back. Nonetheless, it’s holding a still-respectable 7% gain as of this writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Netflix’s gains come as one major problem emerges for anything that’s supported by advertising. Specifically, a general decline in the ad market. The firm’s latest plan to augment its subscription services with ad-supported streams at discount prices could draw new participants to the service, but only if advertisers are willing to advertise. The latest gains suggest that it might be more likely to happen than some expected, even as the economy turns downhill.

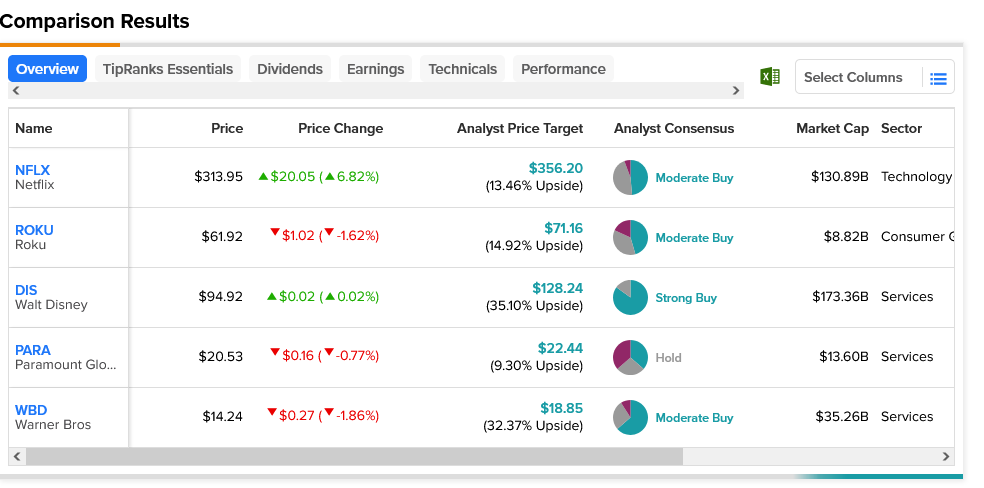

In turn, other media properties also saw their fortunes uptick, if only briefly. Disney (NYSE:DIS) managed to hold on to some of its gains going into the afternoon session. Meanwhile, Roku (NASDAQ:ROKU), Paramount (NASDAQ:PARA), and Warner Bros Discovery (NASDAQ:WBD) had slight gains earlier but eventually turned negative.

Though Netflix was the clear winner in trading gains today, it’s not the overall winner in terms of upside potential. Currently, that would be Disney, with an average price target of $128.24, implying 35.1% upside potential. Further, it’s the only stock in the set that analysts call a Strong Buy. On the other hand, lagging the pack is Paramount, which analysts consider a Hold with an average price target of $22.44, giving it just a 9.3% upside potential.