The more people look at 2023, the less they like what they see. Calls for a recession and wealth destruction seem to be cropping up a lot more often than not. For Netflix (NASDAQ:NFLX), however, there’s a new ray of hope thanks to analyst Steven Cahall at Wells Fargo (NYSE:WFC).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Cahall’s latest research note helped send Netflix up nearly 5% in Friday afternoon’s trading. In that note, Cahall not only upgraded Netflix from “Equal Weight” to “Overweight” but also hiked the price target by $100 to $400.

Cahall noted that Netflix was “…using every arrow in the quiver” in a bid to keep itself at or near the top of the heap. Moreover, Cahall noted that Netflix has “…way more ways to win,” thanks to exciting new content launches like “Wednesday” and “Dahmer – Monster.”

The “Dahmer” title, after all, did reach a major milestone recently, coming in at over one billion hours viewed within 60 days of release. That’s the third such title on the platform to reach that level of viewership that quickly.

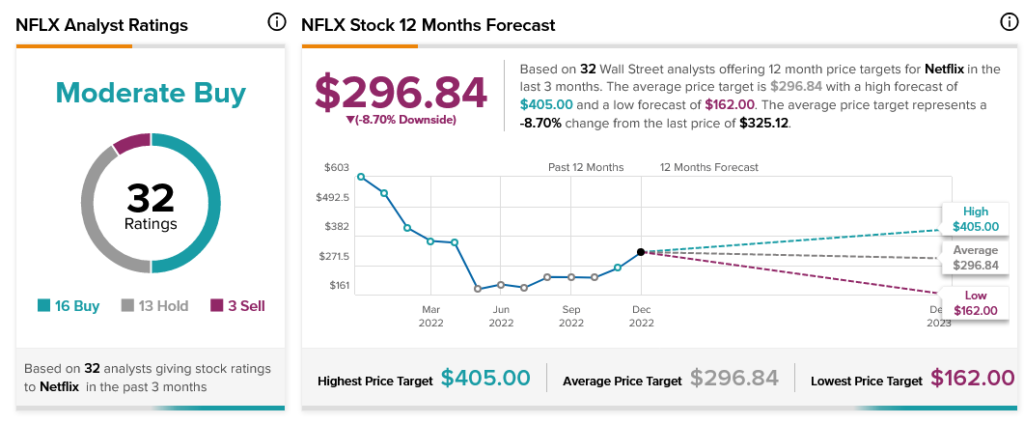

Cahall’s assessment is hardly unique. Only yesterday, Cowen’s John Blackledge reiterated his Buy rating and hiked the price target to $405. However, thanks to Netflix’s current share price and an average price target of $296.84, Netflix shares represent an 8.7% downside risk.