Streaming platform Netflix (NASDAQ: NFLX) unveiled its viewership data in a first for the company. This is a bi-annual report with the data capturing viewing time for 18,000 titles (99% of the Netflix catalog) from January to June 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Interestingly, Netflix has used the metric “hours viewed” for each title rather than views. The company has begun using “views” as the metric to rank its Top 10 lists earlier this year. Views are calculated by hours viewed divided by the runtime, which evens the playing field for all content. In contrast, hours viewed puts shorter videos at a disadvantage and favors longer series, typically dramas.

The data gives some insight into Netflix’s business, such as the viewership of content licensed by Netflix versus its original content. The company’s CEO, Ted Sarandos, commented that licensed content comprised around 45% of all viewership on Netflix in this bi-annual data, while originals made up the other 55%. However, the Top 100 titles were overwhelmingly dominated by original content.

This viewership data revealed insights into Netflix’s renewal decisions, primarily based on performance versus cost. Notably, despite Shadow and Bone being the most-viewed English-language scripted series from January to June, its viewership of 192 million hours translated to about 10% of Netflix’s global subscriber base, possibly explaining its cancellation despite its high budget.

What is the Future Price of Netflix Stock?

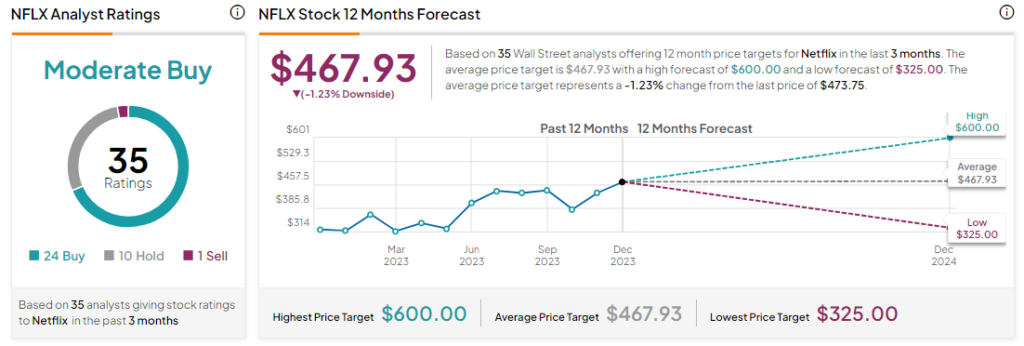

Analysts remain cautiously optimistic about NFLX stock with a Moderate Buy consensus rating based on 24 Buys, 10 Holds, and one Sell. In the past year, NFLX stock has soared by more than 40%, and the average NFLX price target of $467.93 implies a downside potential of 1.2% at current levels.