For the last 10 years or so, Netflix’s (NASDAQ:NFLX) TV app hasn’t changed very much. It’s made a few twists and turns along the way, but nothing particularly major has changed, reports noted. However, that’s about to change as Netflix recently made the biggest changes to its TV app in a decade or so. Investors, meanwhile, weren’t particularly enthused and sent shares of the video streamer down modestly in the closing minutes of Friday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The changes are focused on one key point: connecting users to content and doing so more rapidly. Admittedly, nothing is ever really going to change that “staring-into-the-fridge” kind of thing that happens when you’re looking for something to watch. But if you know what you want or just have an idea, then Netflix is out to hook you up faster. Naturally, the more content you watch, the more ads you consume, and that’s a direct benefit to Netflix’s bottom line.

To that end, Netflix is enlarging its title cards, reorganizing the landing pages, and even adding info nuggets like “(this show) spent eight weeks in the top 10.” Netflix is launching the new app to a limited population before going into wide release.

Backing Changes with Content

Netflix needs to ensure the content will be there for its customers to find, and Netflix is absolutely bringing out the heavy hitters. For instance, Netflix’s original movie “Hit Man” just dropped, and it’s already pulling 98% on Rotten Tomatoes, making it the best original movie that Netflix has put out in quite some time, according to reports. It also brought out “Under Paris,” which, amazingly, is a shark-themed movie.

With Warner Bros Discovery (NASDAQ:WBD) set to launch this year’s “Shark Week” event in another month, it’s a good time to piggyback on some interest. And just to top it off, Netflix landed a coup by getting its own “SpongeBob SquarePants” movie featuring none other than antagonistic restaurateur Plankton.

What Is the Prediction for Netflix Stock?

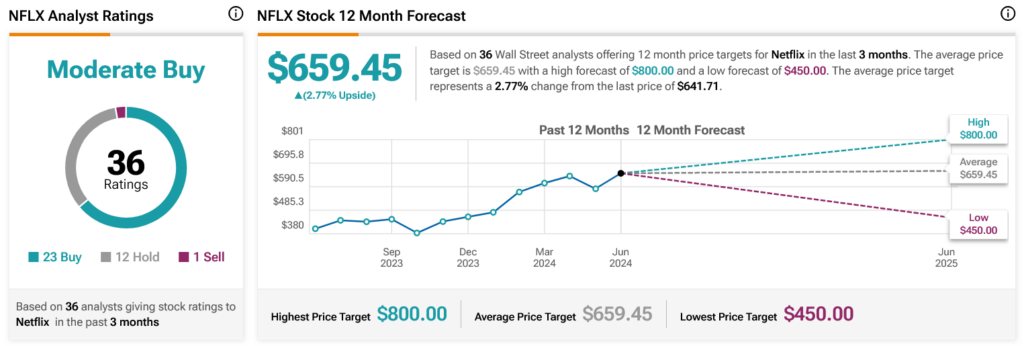

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 23 Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 56.11% rally in its share price over the past year, the average NFLX price target of $659.45 per share implies 2.77% upside potential.