There is no doubt that the last few years have meant a fundamental shift in the streaming video market. With video stores now mostly dead, streaming video has become the main source of entertainment for the average end user. Today, Netflix (NASDAQ:NFLX) is up slightly in the closing minutes of the Monday trading session as it becomes clear just how much the market has changed.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

You’ll remember, back in Netflix’s earliest days, that studios and Netflix lived in a largely symbiotic relationship. Studios handed off their “catalog titles,” mostly older content, to Netflix to stream and pay them healthy licensing fees. Then, studios got the idea to cut out the middleman and build their own platforms, leading to the proliferation of options we have today. That was clearly unsustainable, and now, studios are starting to look to the old ways again. With Wall Street increasingly avid for profitability, licensing is starting to look like the surer bet.

What Scares Netflix?

Studios abandoning their own platforms to give back portions of the market to Netflix sounds great, but what, if anything, gives Netflix pause? A recent study from Variety offered insight therein, as Netflix revealed it’s increasingly concerned about generative AI. In fact, Netflix recently added the tool to its list of “competitive risk factors” in its annual report, and not without reason. If a platform ever were to emerge that would allow users to effectively input their own scripts—or worse, their own ideas—into a tool that would turn them into full-blown movies, the need for Netflix’s content would be significantly reduced.

Is Netflix Stock a Hold or Sell?

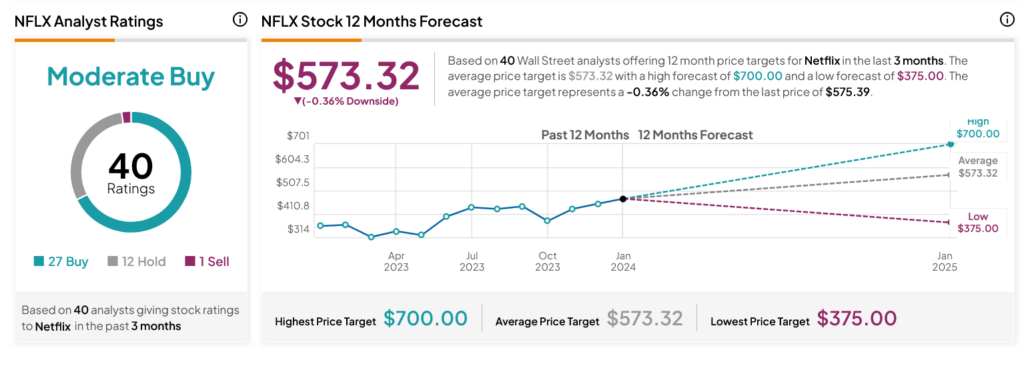

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on five Buys assigned in the past three months, as indicated by the graphic below. After a 63.12% rally in its share price over the past year, the average NFLX price target of $573.32 per share implies 0.36% downside risk.