Two long-serving members of Netflix (NFLX) board of directors have filed to sell about $9 million of company stock each as the share price trades at a record high following the streaming service’s third-quarter financial results.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

NFLX stock was trading near $770 per share mid-day on October 21, not far from its all-time intraday high of $773. The shares have been trending higher after the entertainment company issued a strong quarterly print that surpassed many analysts’ expectations.

Board members Richard Barton and Timothy Haley are each in the process of selling company stock that, combined, totals about $18 million. The stock sales are being made through Rule 10b5-1 plans that have been filed with the U.S. Securities and Exchange Commission (SEC).

Pre-arranged Sales

Such plans execute trades automatically when preset parameters are reached such as the share price reaching a certain level or trading volumes hitting a specific threshold. Such plans are used to remove the appearance of conflict or from allowing insiders at a company to benefit from non-public information.

Barton has been a Netflix director since 2002, the same year the company held its initial public offering (IPO). He is also a co-founder of online real-estate marketplace Zillow Group (Z). Haley has been a Netflix director since 1998 and is a managing director of privately held venture-capital firms Redpoint Ventures and Institutional Venture Partners.

Is NFLX Stock a Buy?

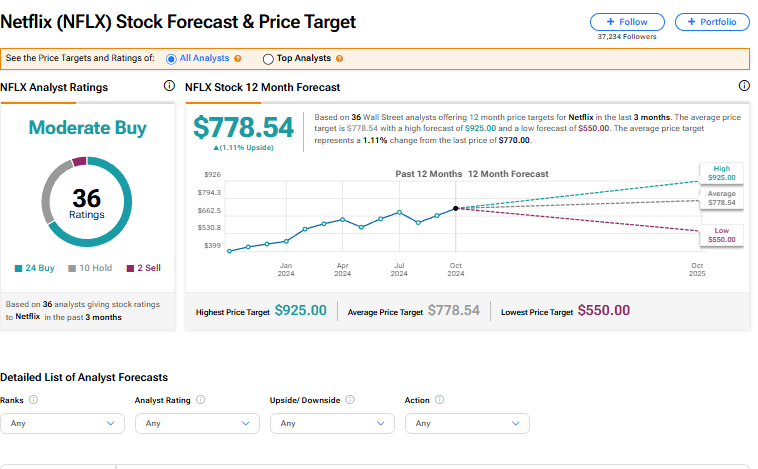

Netflix stock has a consensus Moderate Buy rating among 36 Wall Street analysts. That rating is based on 24 Buy, 10 Hold, and two Sell ratings issued in the last three months. The average NFLX price target of $778.54 implies 1.16% upside from current levels.