Netflix (NASDAQ:NFLX) stock is under pressure, battling lower ARM (Average Revenue per Membership). While the firm has managed to drive subscribers, ARM has come under pressure. Additionally, the streaming giant will terminate its free plan in Kenya after two years, as reported by Reuters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ARM May Continue to Decline

Netflix launched its paid-sharing plan in 100+ countries in the second quarter. The company managed to grow its paid subscriber base, but ARM marked a year-over-year decline in Q2, reflecting a higher mix of membership growth from lower ARM countries and limited price increases over the past 12 months. Given the challenges associated with ARM, NFLX has dropped over 19% since it reported its second-quarter financial results on July 19.

The situation is unlikely to improve in Q3 as well, according to Goldman Sachs analyst Eric Sheridan. Netflix will report its Q3 earnings on October 18, 2023. Sheridan anticipates an uptick in Netflix’s net additions during Q3 but foresees the possibility of the ARM figure remaining stagnant or declining. Sheridan remains sidelined on NFLX stock and reiterated a Hold on October 8.

Echoing similar sentiments, Wedbush analyst Alicia Reese said that growth in lower ARPU (Average Revenue Per User) regions will pressure global ARM. Further, the analyst believes that the “incremental users on the ad-supported tier are still a net drag on ARPU.”

Nonetheless, NFLX stock is on Wedbush’s “Best Ideas” list. Further, Reese expects the company to generate solid free cash flows, reduce churn, and drive ARPU in the long term. The analyst reiterated a Buy on Netflix on October 6.

Kenya Could Boost Netflix’s Subscriber Base

Netflix will be ending its free mobile plan in Kenya on November 1. However, it will continue to offer other plans in the region. The report highlighted that Kenya provides solid opportunities for streaming companies like Netflix to grow their subscriber base.

However, the mix of membership growth from lower-ARM countries like Kenya could remain a drag on its average revenue per member.

With this backdrop, let’s look at what the Street recommends for NFLX stock ahead of Q3 print.

What is the Prediction for Netflix Stock?

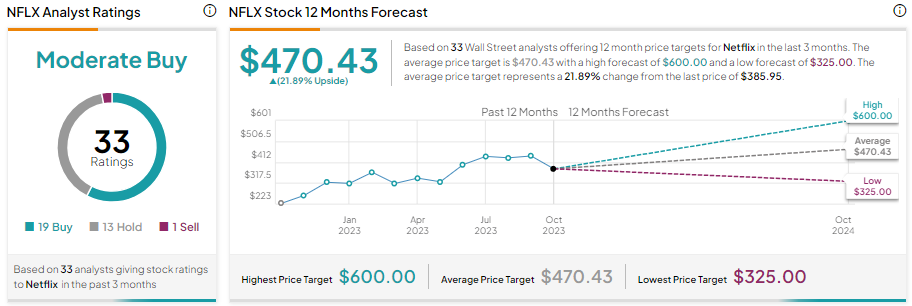

Wall Street analysts are cautiously optimistic about Netflix stock ahead of Q3 earnings, reflecting the ongoing pressure on ARM. It has received 19 Buy, 13 Hold, and one Sell recommendations for a Moderate Buy consensus rating on TipRanks. Meanwhile, analysts’ average price target of $470.43 implies 21.89% upside potential from current levels.