Netflix (NASDAQ:NFLX) will soon announce its third-quarter results, with the streaming giant slated to dial in its report tomorrow after the markets close.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, Netflix kept up momentum in its high-profile live events strategy, with the Canelo-Crawford fight drawing an estimated 41.4 million viewers, making it the most-watched men’s championship boxing match of the century. And in August, KPop Demon Hunters set a new record as Netflix’s most-watched film ever, amassing 325 million views.

BofA analyst Jessica Reif Ehrlich thinks this highlights the company’s “continued ability to scale massive hits out of relatively unknown IP.”

With the Q3 readout approaching, Reif Ehrlich expects the results will meet or slightly beat the company’s guidance across key metrics (revenue, operating income, and EPS). Reif Ehrlich is forecasting revenue of $11.53 billion and operating income of $3.63 billion, both generally the same as Netflix’s outlook.

After substantially outperforming the market over the past few years, the stock’s recent performance has been more muted, with the stock down by 4% during the past 3 months vs. the S&P 500’s 6.5% gain. Reif Ehrlich attributes the lackluster showing to a “combination of competitive threats related to Media M&A as well as from up-and-coming AI players (OpenAI’s Sora etc).”

Following the Paramount Global and Skydance Media (PSKY) merger, press reports suggest that PSKY and the Ellison family are exploring a potential bid for Warner Bros. Discovery (WBD). This comes amid persistent worries over slowing engagement trends, while the emergence of new video formats and a competitor poised to invest heavily in content could “exacerbate these headwinds.” Although a potential PSKY/WBD merger could form a large, well-funded streaming contender, the analyst points out there is no certainty that the deal will actually go through.

“Further,” said Reif Ehrlich, “Netflix’s scale should protect the company’s dominance in video streaming in the near to mid term.”

As for the AI threat, Reif Ehrlich believes that given Netflix’s “DNA as a forward-thinking tech-first company,” she is confident it will be able to navigate both current and emerging changes brought about by AI.

So, ahead of the print, what does all this mean for investors? Reif Ehrlich maintained a Buy rating on the shares along with a price objective of $1,490. That figure suggests the share price will gain ~24% over the coming months. (To watch Reif Ehrlich’s track record, click here)

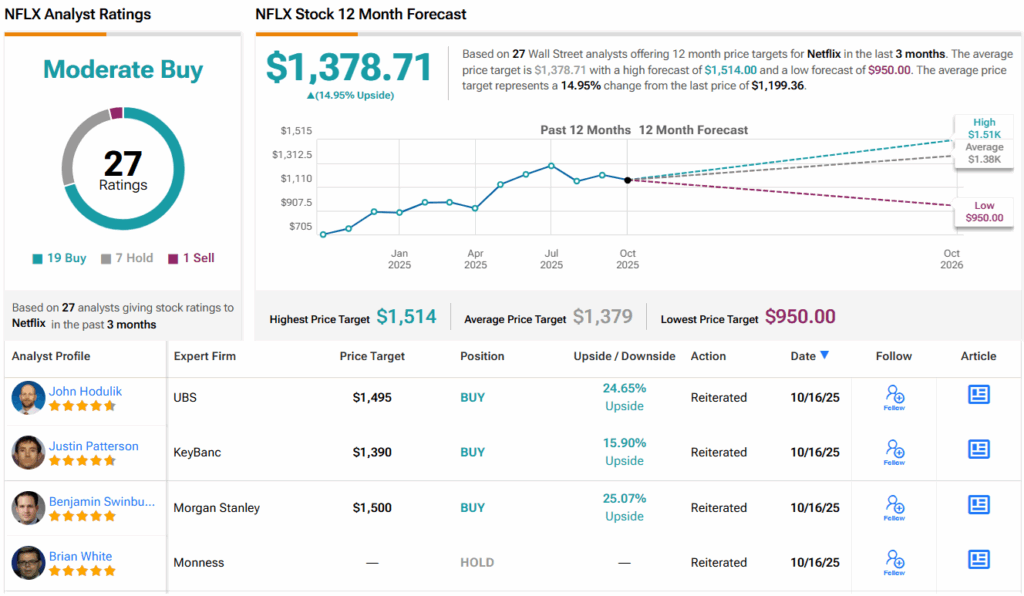

Most on the Street agree with the BofA stance. In total, 19 analysts rate the stock a Buy, and an additional 7 Holds and 1 Sell all add up to a Moderate Buy consensus view. Going by the $1,378.71 average target, over the next 12 months, shares will appreciate by 15%. (See Netflix stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.