Shares of Netflix (NASDAQ: NFLX) were up in morning trading on Friday morning as the streaming giant could add more than 500,000 subscribers in the U.S. and Canada, according to Bank of America analyst Jessica Reif Cohen, citing third-party data. The analyst reiterated a Buy rating on the stock with a price target of $410 which implies an upside potential of around 28% at current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The analyst commented, “Specifically, the data source has indicated that net adds will be greater than +500k for [U.S. and Canada] as gross adds in Canada have accelerated materially.”

Cohen noted that Netflix’s crackdown on password sharing in Canada is going well which “bodes well” for this campaign to be eventually launched in the U.S. The analyst added, “The indication of much stronger than anticipated sub [subscriber] data in Canada is an encouraging sign that NFLX’s recent crackdown on password sharing is driving new subs to the service.”

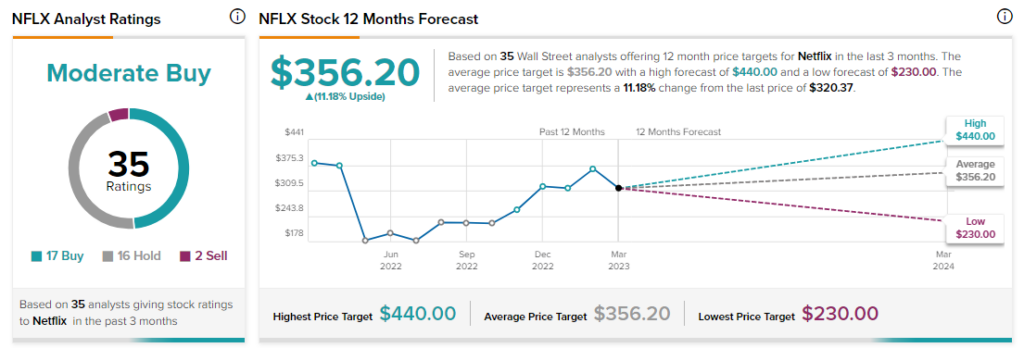

Analysts remain cautiously optimistic about NFLX stock with a Moderate Buy consensus rating based on 17 Buys, 16 Holds and two Sells.