Chinese tech company NetEase (NASDAQ:NTES) is poised to benefit from the planned phase-out and exit of ByteDance from the video gaming business. NetEase develops and operates online PC and mobile games, smart devices, and learning tools. Further, it offers an e-commerce platform, email and advertising services, music streaming, and a payment platform. ByteDance’s exit means NetEase can gain a larger share of the multi-billion dollar Chinese gaming market. Year-to-date, NTES is up 53%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Why is ByteDance Exiting the Gaming Market?

A Reuters report stated that ByteDance is planning to tell its employees today to stop working on new and unreleased games effective December. Meanwhile, the company seeks to divest its already-launched titles under its Moonton Technology unit. Also, it is cutting content staff from its virtual reality unit, Pico. The report also suggested that ByteDance has no plans to re-enter the $185 billion global video games market.

Intense competition from NetEase and Tencent (TCEHY) has led ByteDance to begin restructuring efforts in its gaming business. Moreover, the TikTok maker will cut the workforce from Nuverse, its gaming brand. While commercial operations of Nuverse will be halted, the casual and common games operating on TikTok and the company’s Ohayoo games brand will continue as usual.

Is NetEase a Good Stock to Buy?

Following NetEase’s better-than-expected Q3FY23 results, J.P. Morgan analyst Daniel Chen assigned a price target of $130 (12.6% upside) on NTES while maintaining a Buy rating.

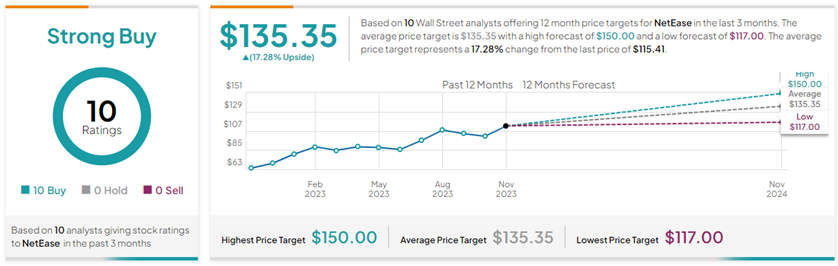

Overall, with ten unanimous Buy ratings, NTES commands a Strong Buy consensus rating on TipRanks. The average NetEase price target of $135.35 implies 17.3% upside potential from current levels.