Cloudflare (NYSE:NET) was already looking pretty good, with several new developments emerging. It even had a hand in taking down the largest manga piracy website in Japan, based on reports from TorrentFreak. As a result, Cloudflare closed up nearly 4% in Wednesday’s trading thanks to some new remarks from Baird, describing how the cybersecurity stock has made impressive new strides.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Robert W. Baird—via analyst Shrenik Kothari—noted that Cloudflare’s big edge is “high-speed network efficiency.” Among the advances Cloudflare has made in that department is the release of Observatory, a system that helps improve network efficiency based on the kind of data it’s generating. A TechCrunch report noted that around 78% of IT decision-makers considered observability—the ability to measure and interpret network efficiency based on generated data—to be a key factor in addressing overall goals in business. Thus, Cloudflare offers up a means to reach goals for large portions of the IT decision-maker market and, ultimately, win their business.

As a result, Kothari hiked his price target from $59 to $64 per share, citing not only what’s been seen so far but what’s set to emerge soon enough. Cloudflare’s connection to artificial intelligence, according to a Motley Fool report, has not only improved Cloudflare’s own response times but has also presented a whole new product line in its Constellation system. It’s currently running in private beta, but once available, customers will be able to use pre-trained AI models with the Workers platform to conduct several new tasks on the edge network.

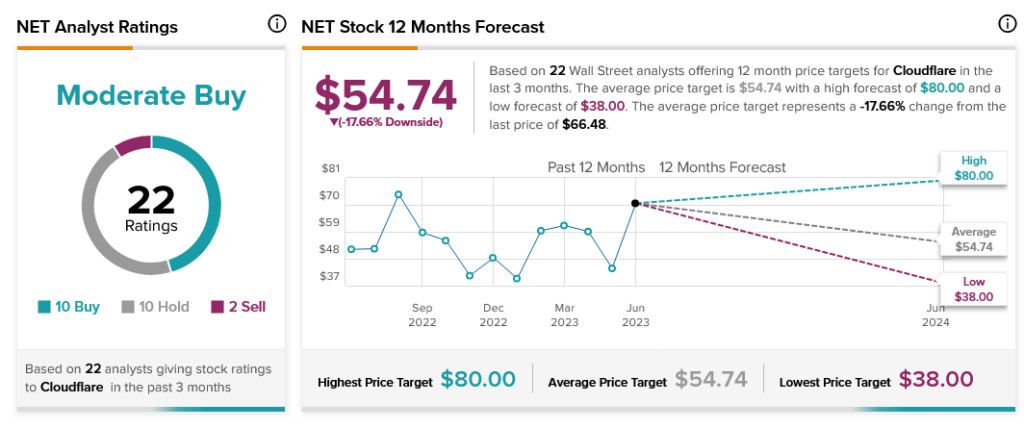

As impressive as this is, overall, analysts are somewhat split on Cloudflare. With 10 Buy, 10 Hold, and two Sell ratings, consensus calls Cloudflare stock a Moderate Buy. Further, with an average price target of $54.74, Cloudflare stock also comes with 17.66% downside risk.