Healthcare stock NeoGenomics (NASDAQ:NEO) hit on all cylinders, and investors rewarded it accordingly. In fact, investors sent shares of NeoGenomics up 22% at the time of writing. Not only did it get a boost from a recent analyst pivot, but it also offers some exciting new fundamentals that prompted that analyst pivot.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The pivot came from analyst Mark Massaro with BTIG, as it upgraded its rating on NeoGenomics’ shares from “Neutral” to Buy. Further, Massaro also stepped up the price target, raising it to $25 per share. This was thanks to a solid first-quarter earnings report. Though NeoGenomics turned in a loss of $0.09, it was projected to lose $0.15, sufficient for a win. Plus, revenue came in at $137.2 million. That not only exceeded the projections of $126.39 million but also represented a 17.1% increase year-over-year.

It also helped that NeoGenomics hiked its revenue forecast as well. Previous guidance suggested that NeoGenomics would turn in revenue between $545 million and $555 million for Fiscal Year 2023. That alone looked pretty good, as consensus estimates called for $549.82 million. But then, NeoGenomics upgraded its outlook and now looks for revenue between $555 million and $565 million. That easily surpasses analyst projections.

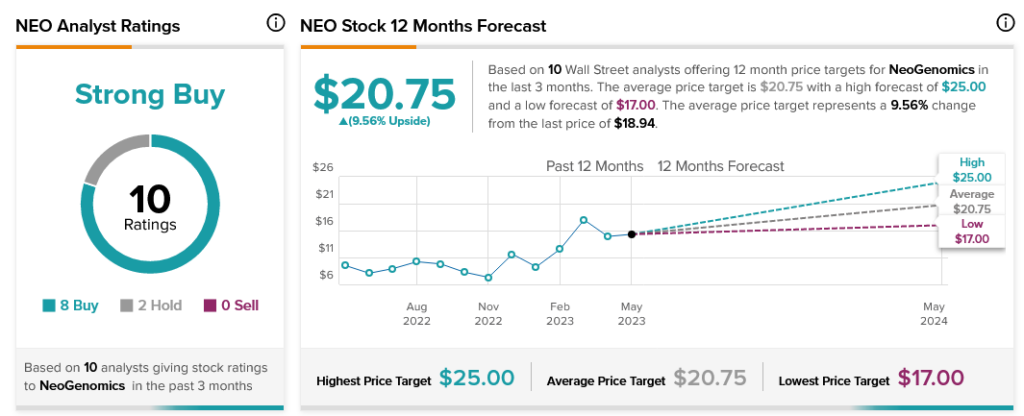

Overall, analysts are very much on NeoGenomics’ side. With eight Buy and two Hold ratings, analyst consensus calls NEO stock a Strong Buy. Plus, it comes with 9.56% upside potential thanks to its average price target of $20.75.