Activist investor Nelson Peltz’s Trian Fund revealed some interesting new stakes in insurer Allstate (NYSE:ALL) and food distributor Sysco (NYSE:SYY). At the same time, the hedge fund increased its stake in entertainment giant Walt Disney (NYSE:DIS). The revelations came in the fund’s regulatory 13F filing for the third quarter ending September 30, listed on November 14.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In October, Reuters reported that Trian had built a stake in the insurance company, the details of which were unknown at the time. The 13F filing shows that Peltz bought 3.64 million shares of Allstate in Q3. Similarly, Trian took a new position in Sysco in Q3 by buying 1.22 million shares.

Turning towards Peltz’s ongoing saga with Disney, Peltz surprisingly added roughly 26.44 million shares of Disney in the third quarter, increasing its stake by a whopping 411% to 32.87 million shares. Trian is engaged in an ongoing proxy fight with Disney and is seeking multiple board seats at the House of Mouse company. Previous reports had indicated that Peltz was closely monitoring Disney’s Q4FY23 results to determine whether to increase the fund’s stake and pursue the battle.

Notably, the fund sold off its entire stake of 16,530 shares in the world’s largest snack maker, Mondelez International (NASDAQ:MDLZ). Meanwhile, Trian also increased its stake in fast food restaurant chain Wendy’s (NASDAQ:WEN) to 33.35 million shares in Q3.

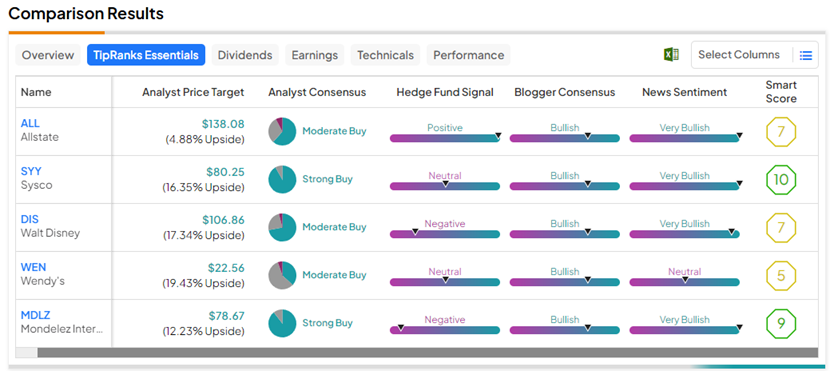

Below is a screenshot depicting the performance of each of these stocks using TipRanks Essentials tools: