Shares of U.S.-based AI server company Super Micro Computer (SMCI) came under pressure after the company reported third-quarter results that fell short of Wall Street expectations. Following the earnings miss, top analysts at Needham and Bank of America (BofA) have quickly revised their price targets lower, signaling caution for investors. SMCI stock slightly rebounded with a gain of 0.88% on Thursday as of this writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Super Micro Computer provides high-performance server and storage solutions, specializing in energy-efficient, AI-optimized infrastructure. Year-to-date, SMCI stock is up nearly 38%.

Needham Analyst Trims SMCI’s Price Target

Five-star-rated analyst Quinn Bolton trimmed his price target on SMCI from $60 to $51 but kept his Buy rating. The price target cut was mainly due to a mixed outlook for Q2, following Super Micro Computer’s Q1 results for fiscal 2026.

Bolton highlighted that Super Micro Computer won the largest design award in its history, boosting revenue projections for both Q2 and the full fiscal year 2026. However, he pointed out that the company warned that higher costs from ramping up the new program and the lower margins tied to this award could put pressure on overall profitability.

Overall, Bolton updated his fiscal 2026 outlook for SMCI, now projecting $36.5 billion in revenue with a 7.1% gross margin, up from his prior estimates of $32 billion in revenue and a 9.9% gross margin.

Bolton’s price target implies an upside of more than 20% from the current level.

BofA Keeps Sell Rating on SMCI

Likewise, BofA’s Ruplu Bhattacharya reduced his price target from $37 to $34 while maintaining his Sell rating. Bhattacharya highlighted concerns over Super Micro’s declining gross margins, which are expected to fall 300 basis points quarter-over-quarter to 6.5% in the December quarter. The margin pressure is driven by engineering, expedited, and overtime costs as the company ramps up production of its new Nvidia (NVDA) GPU racks, including the Blackwell Ultra.

Nonetheless, he highlighted the company’s strong position in the AI server market, with large manufacturing capacity and the ability to ship thousands of liquid-cooled racks each month. Therefore, revenue growth is expected to stay strong as long as AI spending continues. However, he warned that the market is very competitive, and big deals often have lower margins because of bidding pressures.

Is SMCI a Good Stock to Buy?

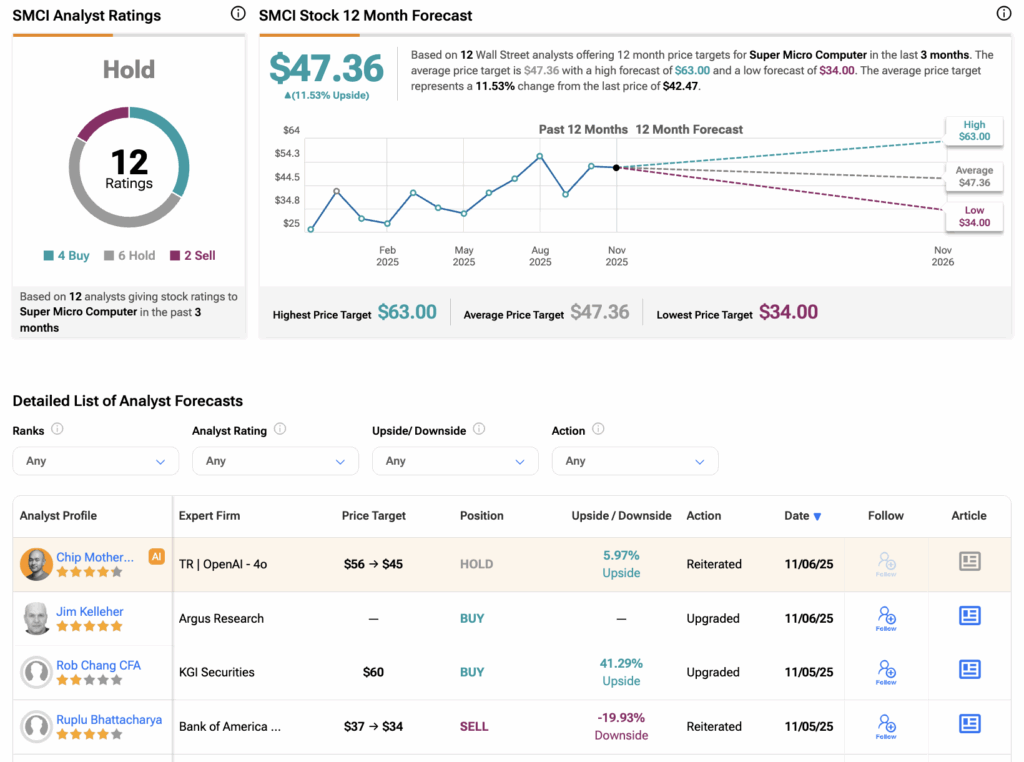

On TipRanks, SMCI stock has a Hold consensus rating based on four Buys, six Holds, and two Sell ratings. Also, the average Super Micro Computer price target of $47.36 implies a 11.53% upside potential from current levels.