A tweet can be costly, and Elon Musk, the man who took over Twitter (now called X), would most likely agree. Back in 2018, the Tesla (NASDAQ:TSLA) founder had claimed in a tweet that he had secured funding to take the EV maker private at $420 per share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

That claim led to a lawsuit by investors against Musk and Tesla. The Securities and Exchange Commission (SEC) estimated that the losses to investors from the tweet were $80 million. Now, a judge will sign off on a payout plan that will see nearly 3,000 Tesla shareholders receiving $12,000 each.

In another development, SpaceX, Musk’s spacecraft and satellite communications company, has been sued by the Department of Justice over hiring discrimination against asylees and refugees.

Today, Phillip Securities’ Jonathan Woo has initiated coverage on Tesla with a Buy rating and a $265 price target. The analyst expects EVs to make up 40% of all new vehicle purchases by 2026.

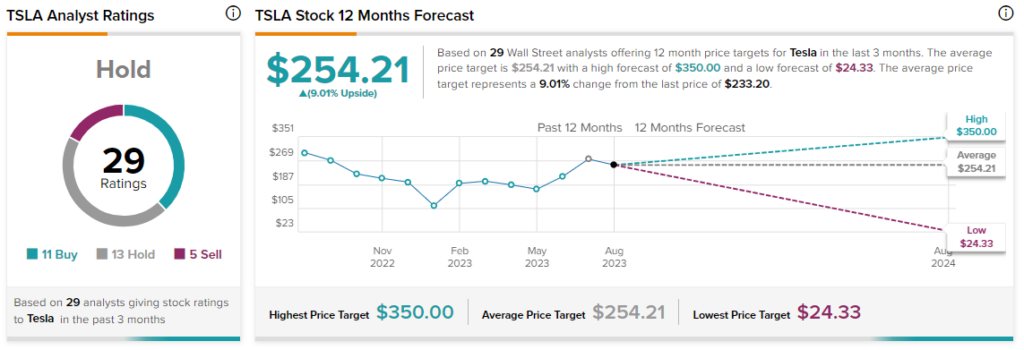

Overall, the Street has a consensus price target of $254.21 on Tesla, accompanied by a Hold consensus rating. Shares of the company have surged nearly 118% year-to-date and more than 1,000% over the past five years.

Read full Disclosure