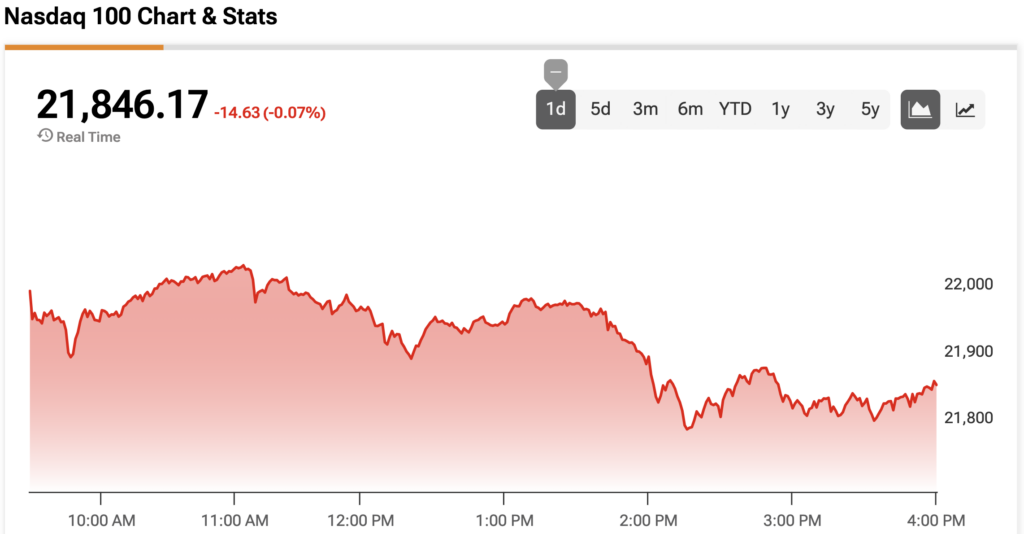

The Nasdaq 100 (NDX) opened the Thursday trading session in the red amid a better-than-expected producer price index (PPI) report. The PPI tracks the prices received by producers for their products and is a gauge of inflation from the sellers’ perspective.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In May, PPI rose by 0.1% month-over-month (MoM) compared to the estimate for 0.2%. That’s still higher than April’s PPI, which was revised to -0.2% from -0.5%. Furthermore, PPI increased by 2.6% on a yearly basis in May, in line with the estimate.

Core PPI, which excludes volatile food and energy prices, rose by 0.1% MoM and 3.0% year-over-year. Economists were expecting 0.3% and 3.1%, respectively.

Is the Good News Priced in?

The PPI report hasn’t resulted in gains for the Nasdaq 100 while the S&P 500 (SPX) is in the red as well. Both indexes have staged incredible recoveries from their April lows, with the NDX up by 27% since then. As a result, the market is likely taking a breather and could potentially consolidate and trade in a range or progress lower.

The Nasdaq 100 is down by 0.07% at the time of writing.