The Nasdaq 100 (NDX) opened lower by 1.32% this morning and has since recovered about a third of its losses. The index was buoyed by comments from Treasury Secretary Scott Bessent at an oversight hearing as well as a rosier forecast from the Atlanta Fed’s GDPNow model.

At the hearing, Bessent noted that a trade deal could come as soon as this week, adding that the U.S. was in tariff negotiation talks with 17 trading partners, excluding China. Bessent also added that no data evidences that the U.S. is currently in a recession.

Furthermore, the Atlanta Fed’s GDPNow forecasts 2.2% real GDP growth for Q2, up from 1.1% on May 1.

The Nasdaq 100 has now shed 0.21% during the past trading week. From April 21 to May 2, the index rose by a significant 12.88%.

Which Stocks are Moving the Nasdaq 100?

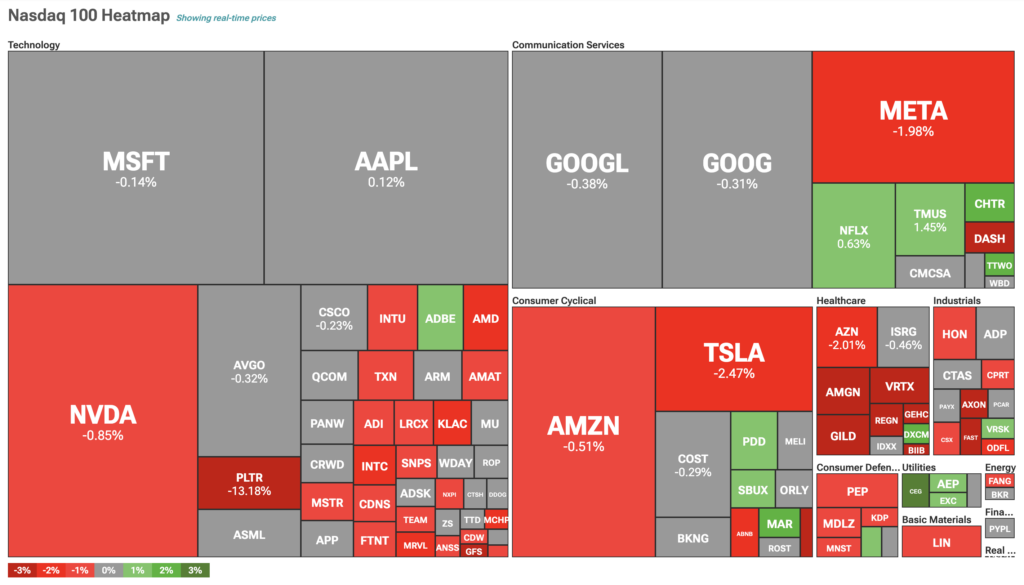

Let’s first take a look at the TipRanks Nasdaq 100 heatmap, which illustrates the stocks that have contributed to the index’s price action. Today, many of the Magnificent 7 stocks have presented muted price action.

Front and center in the technology sector is Palantir (PLTR), which fell by 13% despite a better-than-expected earnings report. The culprit here seems to be the stock’s hefty valuation.

QQQ Stock Falls Alongside the Nasdaq 100

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) designed to track the movement of the Nasdaq 100. As such, QQQ is falling in correlation with the Nasdaq 100 today.

Wall Street is quite bullish on QQQ stock. During the past three months, analysts have issued an average price target of $574.61 for the stocks within the index, implying upside of 19.55% from current prices. The 102 stocks in the QQQ carry 88 buy ratings, 14 hold ratings, and zero sell ratings.