Shares of life sciences research tools provider NanoString Technologies (NASDAQ:NSTG) have nosedived today owing to its disappointing third-quarter performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

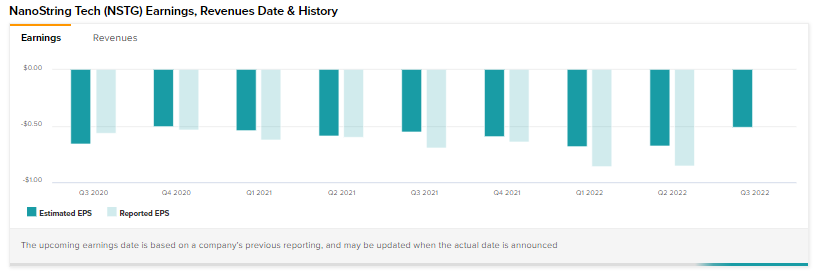

While revenue dropped 20.48% year-over-year to $29.54 million, net loss expanded to $36.69 million from $31.26 million a year ago. Net loss per share at $0.79 came in wider than expectations by $0.28.

During the quarter, NSTG bagged about 60 orders for spatial biology instruments clocking a 70% growth over the prior year period. The company currently has orders for over 100 CosMx systems and expects to generate revenue from them in the coming weeks.

Further, NSTG is taking steps to streamline costs and expects to hit cash break-even with its current resources. At present, it has a cash balance of $230.5 million.

For 2022, NSTG expects total product and service revenue to range between $125 million and $127 million. This is a significant drop from the earlier expected range between $140 million and $150 million. Adjusted EBITDA loss is anticipated at about $100 million versus the previous outlook in the range of $75 million and $85 million.

Shares are now down ~91% over the past 52 weeks.

Read full Disclosure