Sell, sell, sell! Those are the words that likely echoed through Nancy Pelosi’s head as she released word of her stock trading disclosures going into the end of the year. The big sell-off in the Pelosi portfolio featured names like Netflix (NASDAQ:NFLX), Tesla (NASDAQ:TSLA), Disney (NYSE:DIS), and Alphabet (NASDAQ:GOOGL). In fact, reports note that the former Speaker of the House lost big on her end-of-year closeout event. That may also have done wonders for her tax picture as well.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The word came out of Congress Trading, a group that maintains a database following congressional trading, and the info got support from required congressional trading forms. Pelosi reported selling a hefty slice of Google that was valued between $500,001 and $1 million outright. She also ditched 1,000 shares of Netflix worth between $250,001 and $500,000. Another 5,000 shares of Tesla valued at over half a million dollars left the portfolio, as did 10,000 shares of Disney.

Pelosi’s portfolio is under intense scrutiny. Not just by conservative voters looking for a prod to use against the former Speaker but also by retail investors looking for an edge. TikTok investors refer to Pelosi as “…the stock market’s biggest whale” and “a psychic,” among other things. Nancy alone isn’t the only watched case, though; her husband, Paul Pelosi, also turned in some sales and losses. One report notes that Pelosi lost over $2.5 million in 2022’s closing weeks. Some speculate this was a move to reduce the amount of taxes required for 2023.

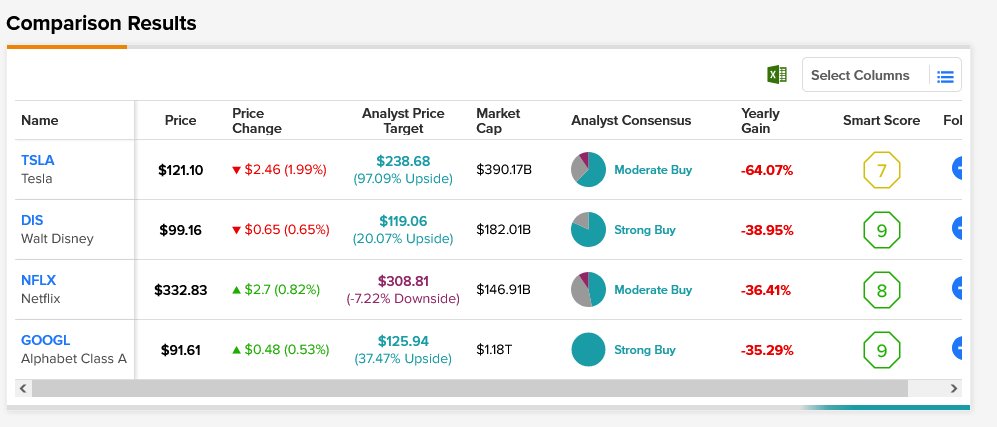

Pelosi’s portfolio covers a wide range of stocks in a wide range of industries. Further, each turned in a wide range of performances as well. Analyst consensus, for example, considers Netflix a Moderate Buy, but its average price target of $308.81 per share means its stock offers 7.22% downside risk. Meanwhile, Tesla also rates as a Moderate Buy, but its average price target of $238.68 per share gives it a shocking upside potential of 97.09%.