Elon Musk‘s AI startup, xAI, is set to surpass $100 million in annual revenue and may launch a standalone app for its Grok chatbot as early as next month, according to The Wall Street Journal. Most of xAI’s revenue comes from Musk’s other ventures, as Grok is currently exclusive to users of the X social network (formerly Twitter) and supports SpaceX’s Starlink customer service. Interestingly, though, the report noted that it may also power a potential search engine for X moving forward.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Grok chatbot will likely be looking to compete with platforms like OpenAI’s ChatGPT or Google’s Gemini, which recently launched on iOS. xAI released its first API, “grok-beta,” in October, with pricing at $5 million per million input tokens or $15 million per million output tokens. The models behind the API, Grok-2 and Grok-2 mini, were announced in August, but it’s unclear if they are the ones currently in use.

Tesla May Invest $5B into xAI

Back in July, Musk floated the idea of Tesla (TSLA) investing $5 billion into xAI and received strong support in an online poll. As a result, he said that he would bring the proposal to Tesla’s board. Although no updates have emerged about this idea, xAI managed to raise $6 billion in funding at a $50 billion valuation earlier this month. Some of the funds are being used to build a massive data center in Memphis that will be equipped with 100,000 Nvidia H100 GPUs.

What Is a Good Price for Tesla Stock?

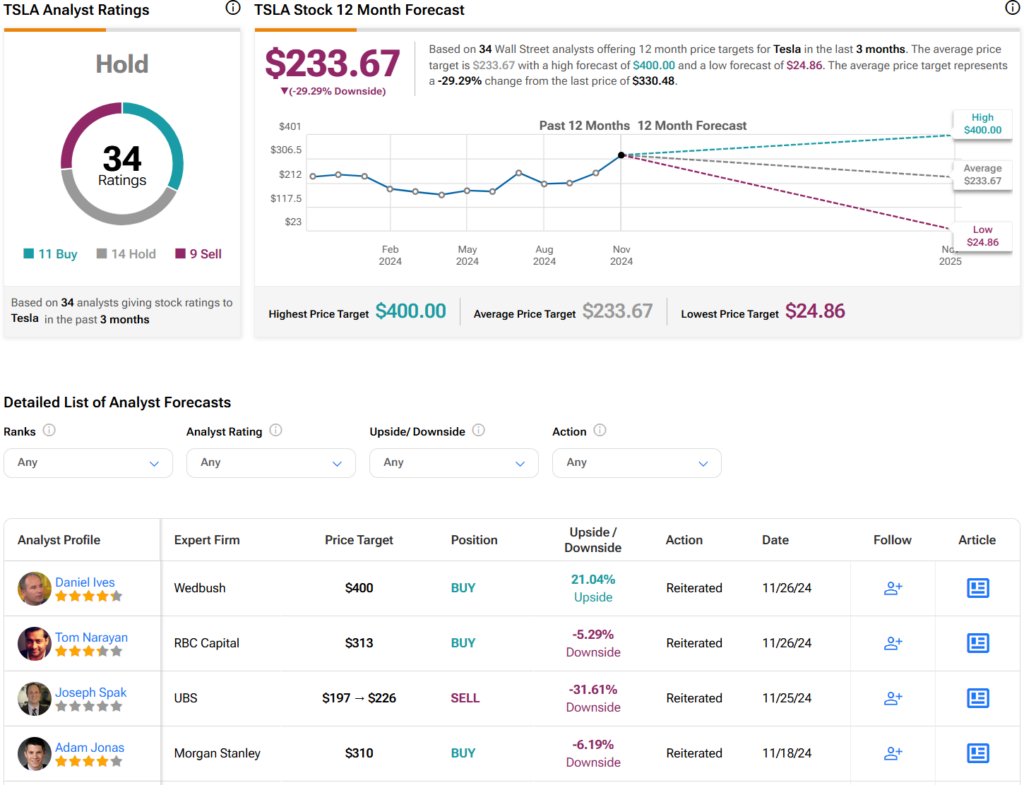

Although retail investors cannot invest in xAI due to its status as a private startup, they can invest in Musk’s most popular venture, Tesla. Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 11 Buys, 14 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. After a 61% rally in its share price over the past three months, the average TSLA price target of $233.67 per share implies 29.3% downside risk.