Elon Musk’s spacecraft and satellite communications company SpaceX has sued the U.S. Department of Justice (DOJ) to end its discrimination case against the company. Per a Wall Street Journal report, SpaceX labeled the DOJ’s lawsuit as unconstitutional, asserting that the matter would be heard in an administrative court and not in a federal court with a jury.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors should note that the DOJ initiated legal action against SpaceX last month, claiming the company engaged in discriminatory practices during its hiring procedures.

The DOJ alleged that SpaceX hired only U.S. citizens and lawful permanent residents from at least September 2018 to May 2022. To defend its move, SpaceX said it is under federal regulations and adheres to the “export control laws” for hiring. In doing so, SpaceX discriminated against asylees and refugees in hiring, the DOJ lawsuit claimed.

While the outcome of these lawsuits remains uncertain, the company has turned profitable, which is positive. Further, SpaceX repeatedly helps Musk to raise cash for his endeavors. For example, SpaceX, in the past, provided a $20 million loan to Musk to support his then-struggling EV (electric vehicle) company, Tesla (NASDAQ:TSLA). Tesla has since emerged as the leader in the EV space, with its stock price delivering massive gains. As Tesla continues to focus on defending its EV leadership, let’s look at what the Wall Street analysts recommend for the stock.

Is Tesla Stock Predicted to Go Up?

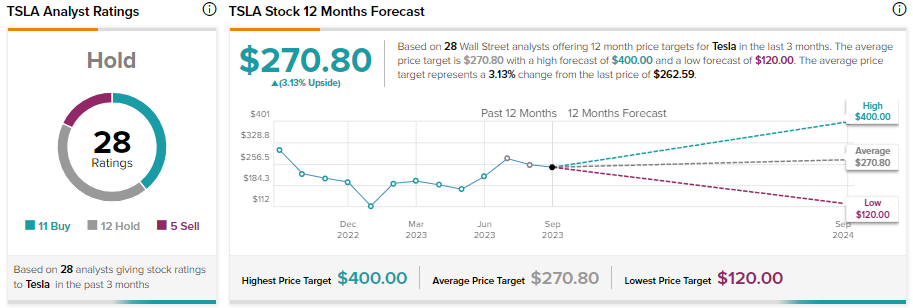

Tesla stock has gained over 113% year-to-date. Given the significant appreciation in its price and short-term pressure on margins, analysts remain sidelined on TSLA stock. Moreover, analysts’ average price target shows limited upside potential.

Tesla shares have received 11 Buys, 12 Holds, and five Sells for a Hold consensus rating. Analysts’ average 12-month price target of $270.80 implies a marginal upside potential of 3.13% from current levels.