Billionaire investor Elon Musk’s Space Exploration Technologies company is growing rapidly, both in terms of successful satellite deployment and valuation. The company has achieved the status of being a Centicorn (a unicorn with over $100 billion in valuation), as it reaches a record valuation. SpaceX offered an agreement to new and existing investors to sell up to $750 million in stock for $81 apiece, a CNBC report stated. This secondary share sale round officially puts the company’s valuation at $150 billion, the highest one for a private company so far.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SpaceX undertakes secondary share sale rounds twice each year to give employees and other investors a chance to sell shares. SpaceX’s valuation is growing fast, from $127 billion in May 2022 to $137 billion in January 2023, and now to $150 billion in July. The latest share price of $81 shows a 5% jump over January’s price of $77 per piece. The new purchase order was sent by CFO Bret Johnsen yesterday. Musk noted in April this year that he does not foresee SpaceX requiring any further funding shortly to run its Starship or Starlink programs.

Musk’s Successful Missions

There is no looking back on Musk’s space venture, which has successfully launched roughly 5,000 internet satellites into space and boasts 1.5 million subscribers worldwide to date. While the company’s commercial space travel mission is progressing at a slow pace, internet provider Starlink is making waves in the sector. The internet provider could also go public no sooner than 2025.

Musk also started a new artificial intelligence (AI) company called xAI, whose purpose is to help people understand “the nature of the universe.” Meanwhile, his other venture, social media platform Twitter, is facing a slew of challenges of its own. Finally, his electric vehicle baby, Tesla (NASDAQ:TSLA), is steadily gaining market share and delivering a record number of vehicles each quarter. TSLA stock has zoomed 157.1% so far this year.

Is Tesla Share Good for the Long Term?

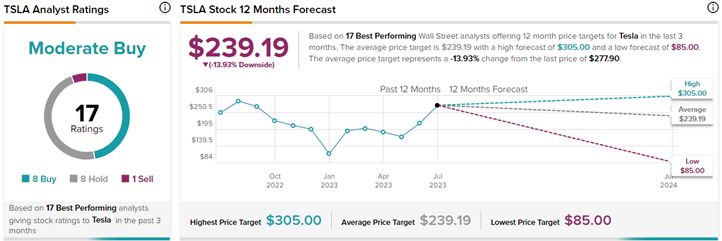

Wall Street remains cautiously optimistic about Tesla’s stock trajectory. On TipRanks, Tesla has a Moderate Buy consensus rating based on eight Buys, eight Holds, and one Sell rating. Also, the average Tesla price forecast of $239.19 implies 13.9% downside potential from current levels.