Elon Musk’s SpaceX is raising $750 million in a fresh round of funding that values the space exploration and satellite company at $137 billion, CNBC reported. As per an e-mail sent to prospective SpaceX investors, Andreessen Horowitz, also known as a16z, is expected to lead the new round of funding.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Horowitz had earlier invested in SpaceX along with Founders Fund, Sequoia, Gigafund, and many other investors. Horowitz was also a co-investor in Musk’s $44 billion acquisition of social media platform Twitter. The latest round of funding reflects an increase in SpaceX’s valuation compared to about $127 billion in mid-2022, when it raised nearly $1.7 billion.

SpaceX competes with Amazon (AMZN) founder Jeff Bezos’ space company Blue Origin and billionaire Richard Branson’s Virgin Galactic Holdings (SPCE). Last month, the company tweeted that its Starlink satellite internet service now has over 1 million active subscribers. The rapid growth of Starlink is worrisome for ViaSat (VSAT), Amazon’s Kuiper Systems, and Dish Network (DISH).

While SpaceX’s valuation has increased, the valuation of Musk’s electric vehicles company Tesla (TSLA) declined last year amid persistent supply chain and macro pressures as well as growing concerns about CEO Musk’s Twitter-related distraction. Overall, Tesla stock declined 65% last year.

SpaceX has delivered cargo to the International Space Station several times for the NASA. It has also launched astronauts to the space station. Last month, as per NBC News, NASA administrator Bill Nelson questioned Gwynne Shotwell, SpaceX’s president and COO, “Tell me that the distraction that Elon might have on Twitter is not going to affect SpaceX.” Shotwell assured it will not have any impact on SpaceX and that there was nothing to worry about.

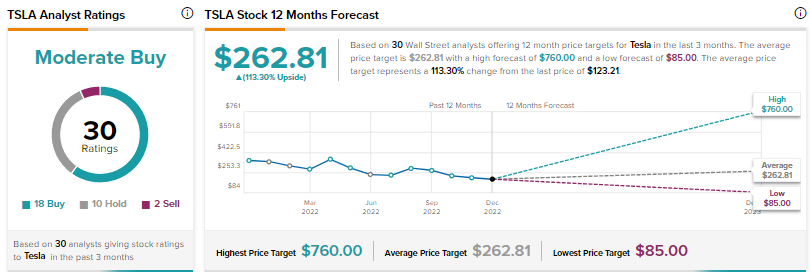

What is the Target Price for Tesla?

Wall Street’s Moderate Buy consensus rating for Tesla stock is backed by 18 Buys, 10 Holds, and two Sells. At $262.81, the average TSLA stock price target of $262.81 implies 113.3% upside potential.