Tesla (TSLA) CEO Elon Musk confirmed that production of the EV company’s fully autonomous Cybercab will begin in April 2026. Speaking at Tesla’s 2025 Annual Shareholder Meeting, Musk explained that the Cybercab will be the company’s first vehicle built entirely for unsupervised self-driving. Unsurprisingly, Musk described the Cybercab as a completely new type of car, made specifically for a world where no one needs to drive.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It won’t have a steering wheel, pedals, or side mirrors, and it’s designed to operate at the lowest cost per mile possible in autonomous mode. The vehicle will be produced at Tesla’s Giga Texas factory and will serve as the company’s main entry into the commercial robotaxi market. Musk stated that the project is the next step for Tesla and combines advanced manufacturing, artificial intelligence, and mobility services into one system.

What really stood out from Musk’s comments was the scale of Tesla’s production goals. He said that the Cybercab will be built using a process more like consumer electronics than traditional car manufacturing, allowing production to move much faster. More specifically, Musk said that Tesla is aiming for a “10-second cycle time,” meaning one Cybercab could roll off the line every 10 seconds. At that speed, a single factory could eventually produce between 2 and 3 million vehicles per year and possibly up to 5 million if improvements continue.

What Is the Prediction for TSLA Stock?

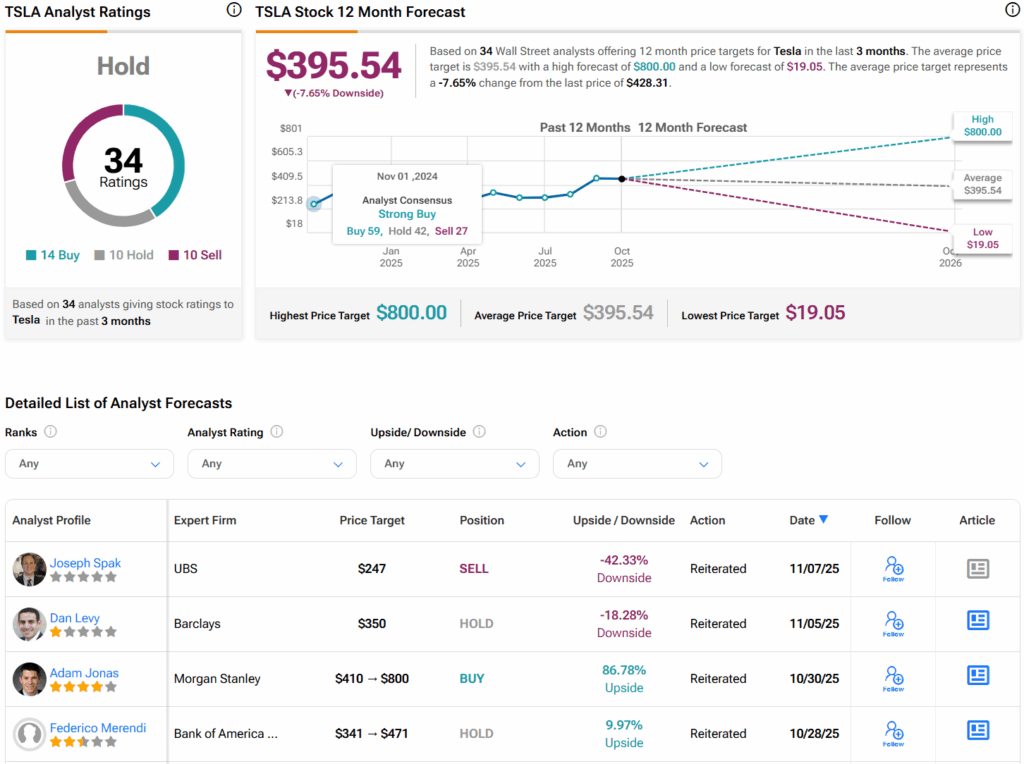

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 10 Holds, and 10 Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $395.54 per share implies 7.7% downside risk.