The artificial intelligence market may be looking at a sea change in the short term as Elon Musk looks to enter the field with xAI. The plan offered up a halo effect to several other AI stocks, with Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) all up fractionally in Friday morning’s trading as a result.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Musk’s planned AI startup, xAI, is already making the rounds of discussion and pulling some impressive talk about valuation, too. Reports suggest it could raise as much as $6 billion against a potential valuation of $20 billion. Musk has been on a world tour to raise cash, working with Middle East sovereign wealth funds and Hong Kong family offices to land the dough.

Interestingly, xAI itself had previously only expressed a goal of $1 billion but is well on track to raise significantly more than that. Although $20 billion would still be far behind OpenAI, it would be a rough match for Google’s creature Anthropic.

The Big Names are in the Firing Line

Musk’s startup comes at an interesting time for AI; it turns out that Microsoft, Amazon, and Google are all now under a Federal Trade Commission (FTC) investigation over their connections to the various AI projects they’re supporting. Right now, it seems mostly fact-finding, but given the nature of such investigations, it could turn predatory quickly. The FTC plans to “…scrutinize corporate partnerships and investments with AI providers to build a better internal understanding of these relationships and their impact on the competitive landscape.” That, in turn, might mean good news for Musk, who will certainly be coming in as a competitor to these platforms.

Which AI Stocks are a Good Buy Right Now?

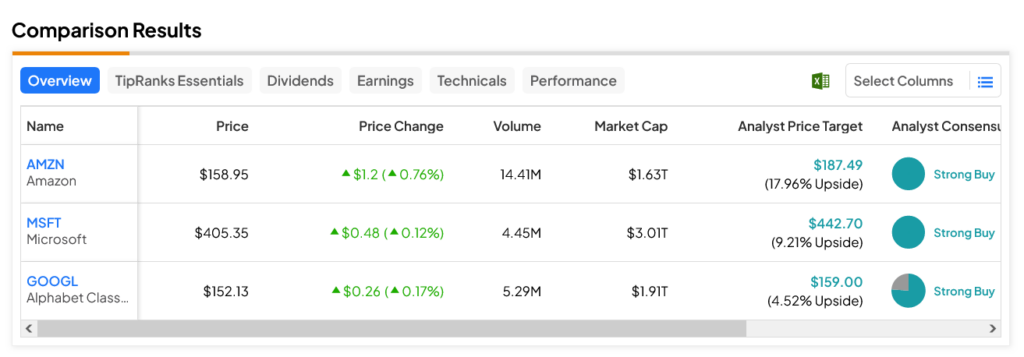

Turning to Wall Street, Strong Buy-rated AMZN stock is the clear leader among the three mentioned today, with a 17.96% upside potential on its $187.49 average price target. Meanwhile, GOOGL stock is the laggard, as this Strong Buy with a $159 price target can only offer a 4.52% upside potential.