Shares of Mullen Group (MLLGF) (TSE:MTL) declined over 9% yesterday despite the company reporting record earnings and revenues for the third quarter of FY2022.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Mullen Group Ltd is a logistics company that owns a network of independent businesses offering trucking, logistics, and a wide range of related services in Canada.

A Snapshot of Mullen Group’s Q3 Results

Adjusted earnings of $0.51 per share more than doubled year-over-year compared to earnings of $0.19 per share in the prior-year period.

Further, revenues jumped 19.9% year-over-year to $518.4 million and exceeded consensus estimates by $135.91 million. The revenues crossed the $500 million mark for the second consecutive quarter, driven by robust demand and pricing and incremental revenues from acquisitions made.

Is MTL a Good Stock to Buy?

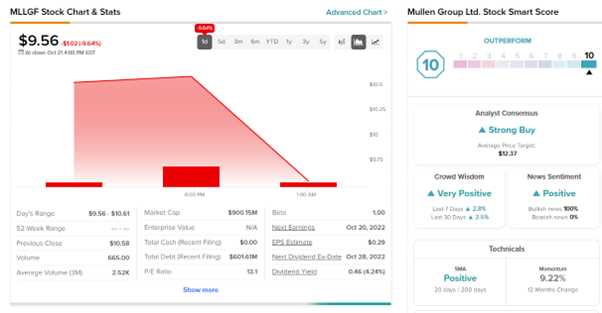

The Wall Street community is clearly optimistic about the stock. Overall, the stock commands a Strong Buy consensus rating based on six Buys and two Holds. Mullen Group stock’s average price target of $12.37 implies 29.36% upside potential from current levels.

Despite the upbeat Q3 results, RBC Capital analyst Walter Spracklin downgraded Mullen Group from Buy to Hold with a price target of $9.43 (1.4% downside potential).

On the positive side, MLLGF stock has a top-notch Smart Score of a “Perfect 10” on TipRanks, indicating that the stock has strong potential to outperform market expectations.

Read full Disclosure