Shares of Micron Technology (NASDAQ:MU) are down at the time of writing, puzzling many as the company had just reported a strong third quarter that surpassed Wall Street’s expectations. Piper Sandler’s analyst, Harsh Kumar, upgraded his stance on Micron, shifting it from ‘underweight’ to ‘neutral.’ He highlighted signs of improved volume and pricing in the second half of the year and also noted that Micron’s management comments suggest that the company has weathered the worst of the revenue downturn as inventory levels for PCs and smartphones approach normalcy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, J.P. Morgan’s Harlan Sur reiterated his ‘overweight’ rating and set a per-share price target of $75 for Micron. He affirmed that the company has entered a “stabilization phase,” suggesting the team had moved beyond the low point of the cycle following a drawn-out inventory destocking period. Sur expects a steady improvement in bit shipments, pricing, and margins throughout the second half of the year and reduced customer inventories. He also predicted that Micron shares are poised to “move in a positive direction” throughout 2023 as the market anticipates a recovery in revenue, pricing, and margin.

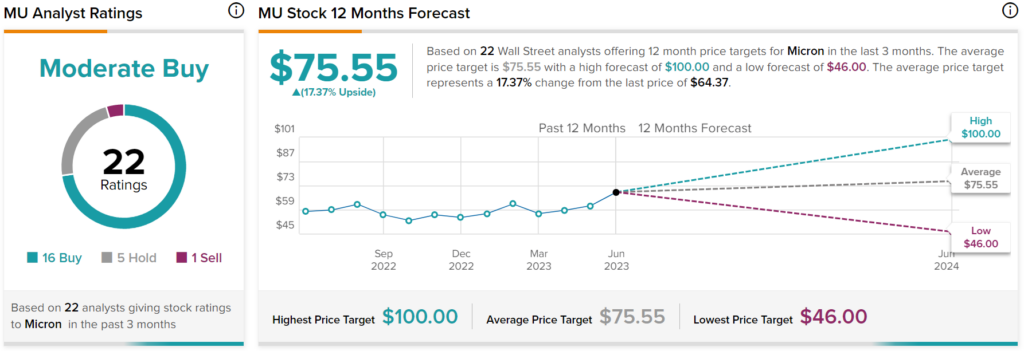

Overall, analysts have a Moderate Buy consensus rating on MU stock based on 16 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic above. In addition, the average price target of $75.55 per share implies 17.37% upside potential.