The Federal Trade Commission (FTC) has put forward some strong arguments in the ongoing five-day trial, that will determine the fate of Microsoft (NASDAQ:MSFT) and Activision Blizzard’s (ATVI) $69 billion merger deal. Based on MSFT’s behavior following its acquisition of ZeniMax Media, the FTC has raised concerns that the tech giant may intend to establish a monopoly in the highly profitable video game market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the Federal Trade Commission (FTC), Microsoft’s acquisition of gaming conglomerate ZeniMax Media for $7.5 billion in 2020 prompted the tech giant to prioritize exclusive, high-quality titles. This move represents a departure from Microsoft’s previous approach of making its video games available across multiple gaming consoles. The FTC has pointed to this acquisition as evidence of a strategic shift towards emphasizing exclusive content within the gaming industry.

Additionally, the FTC mentioned that after the purchase, MSFT made games like Redfall, Indiana Jones, and the role-playing game Starfield exclusive to its Xbox and Windows platforms. Thus, the FTC fears that MSFT might adopt a similar approach to Activision’s popular shooter game, Call of Duty, and refrain from sharing it with competitors once the merger deal is finalized.

The Courtroom Battle Continues

In the first four days of the big courtroom battle, several key executives of Microsoft, including head of Xbox Game Studios Matt Booty, Microsoft Gaming chief Phil Spencer, and CEO Satya Nadella, testified during the trial.

Interestingly, Nadella reflected his dislike for the exclusive agreements between console manufacturers and video game companies. He blamed Sony (SONY), a dominant player in the console market, for using exclusives to shape market competition. At present, companies are required to sign such exclusive contracts in order to boost sales of video games and consoles. Nevertheless, Nadella assured the courtroom that if the acquisition is approved, Microsoft will continue to offer Activision games on competing platforms.

For those unaware of the FTC-MSFT clash, the FTC seeks a preliminary injunction to prevent Microsoft from closing the deal until a separate legal challenge begins on August 2. The regulatory body has expressed concerns that MSFT has the potential to gain complete control over the entire market for cloud gaming services with the ATVI acquisition.

Importantly, If MSFT is unable to close the proposed acquisition by July 18, it will be required to either pay Activision $3 billion in breakup fees or renegotiate the terms of the agreement.

Is Microsoft a Buy, Sell, or Hold?

Based on MSFT’s strong position in the tech sector, Wall Street continues to have a Strong Buy consensus rating for the stock. This is based on 30 Buys, four Holds, and one Sell. The average stock price target of $347.94 suggests about 3.6% upside potential from current levels. Shares have gained 40.8% year-to-date.

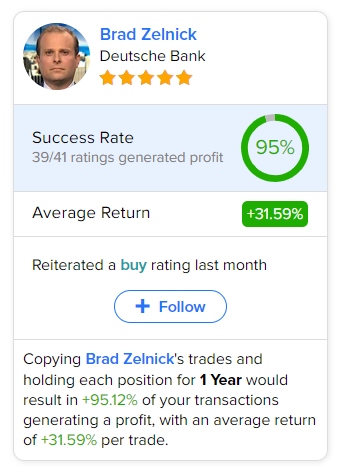

As per TipRanks data, the most accurate analyst for Microsoft is Deutsche Bank analyst Brad Zelnick. Copying the analyst’s trades on this stock and holding each position for one year could result in 95% of your transactions generating a profit, with an average return of 31.59% per trade.