Morgan Stanley (MS) stock jumped on Wednesday after the financial company posted record results in its Q3 2025 earnings report. This report began with diluted earnings per share of $2.80, which was well above Wall Street’s estimate of $2.10. It also represented a 48.94% increase year-over-year from $1.88.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley reported revenue of $18.22 billion during the third quarter of 2025. Yet again, that surpassed analysts’ revenue estimate of $16.69 billion and was an 18.5% gain compared to Q3 2024 revenue of $15.38 billion. The company said its revenue growth came from “the strength of our Integrated Firm with strong contributions across each of our businesses and geographies.” It also pointed out a return on tangible equity (ROTE) of 23.5% during the quarter.

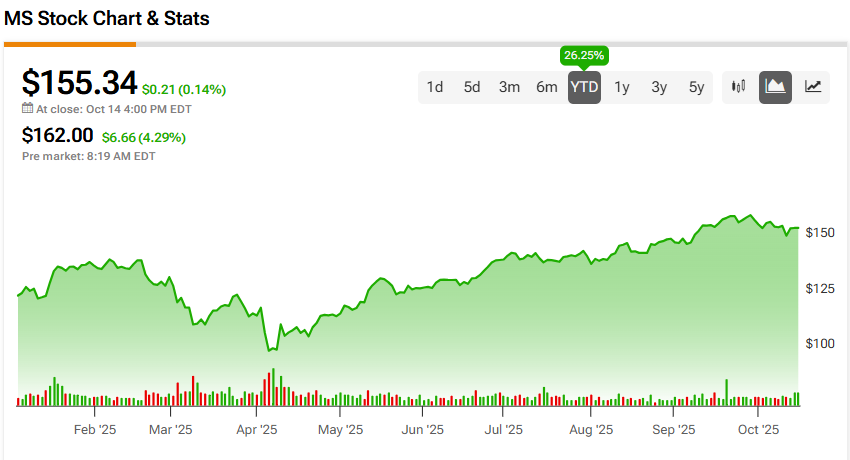

Morgan Stanley stock was up 4.29% in pre-market trading on Wednesday, following a 0.14% increase yesterday. The stock has gained 26.25% year-to-date and 29.98% over the past 12 months.

Morgan Stanley Guidance

Morgan Stanley, like many financial companies, didn’t provide formal guidance in its most recent earnings report. Even so, Chairman and CEO Ted Pick did discuss its future. He highlighted the company’s strong Q3 performance and said, “Across our global footprint, we remain committed to generating durable growth to drive long-term value for our shareholders.” Pick didn’t comment on larger economic issues, as other bank leaders have.

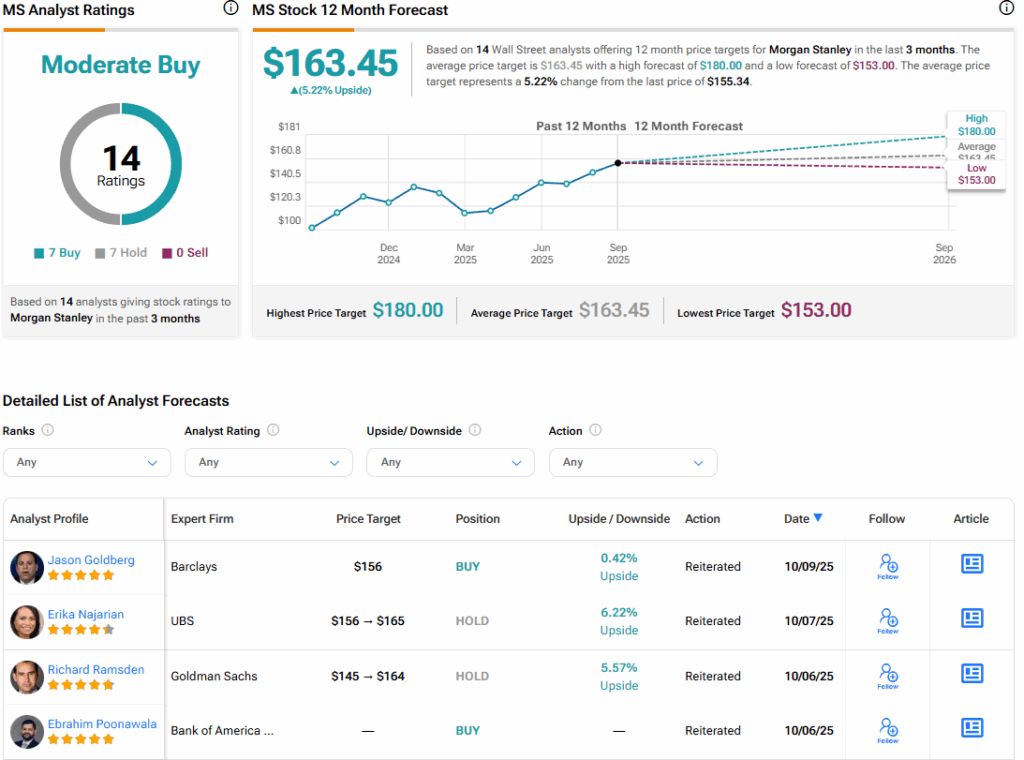

Is Morgan Stanley Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Morgan Stanley is Moderate Buy, based on seven Buy and seven Hold ratings over the past three months. With that comes an average MS stock price target of $163.45, representing a potential 5.22% upside for the shares. These ratings and price targets will likely change as analysts update their coverage following today’s earnings report.