Shares of Marvell Technology (NASDAQ:MRVL) soared 25% at the time of writing, following a solid Q1 performance and optimistic guidance. Marvell’s projections of its AI-related revenue doubling in fiscal 2024 caught Wall Street’s attention.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Barclays analyst, Blayne Curtis, highlighted the appeal of Marvell as a safer bet for investors interested in the AI sector, comparing the company’s potential to Nvidia (NASDAQ:NVDA) and other AI-driven stocks. Last year, Marvell’s AI business accounted for $200 million in revenue, which is anticipated to double in each of the upcoming fiscal years.

Analysts have also expressed optimism toward Marvell’s strategic communication. Citi’s Atif Malik applauded the company for distinguishing between AI and non-AI data center sales during its earnings call, which he believes will help investors better understand the AI sector’s growth.

Meanwhile, Wells Fargo’s Gary Mobley acknowledged Marvell’s ongoing inventory issues but noted a quicker-than-expected recovery. Mobley predicts the company’s growth to significantly outpace the overall chip market in 2024, suggesting an additional $500M in storage-related revenue next year, along with improved gross margins.

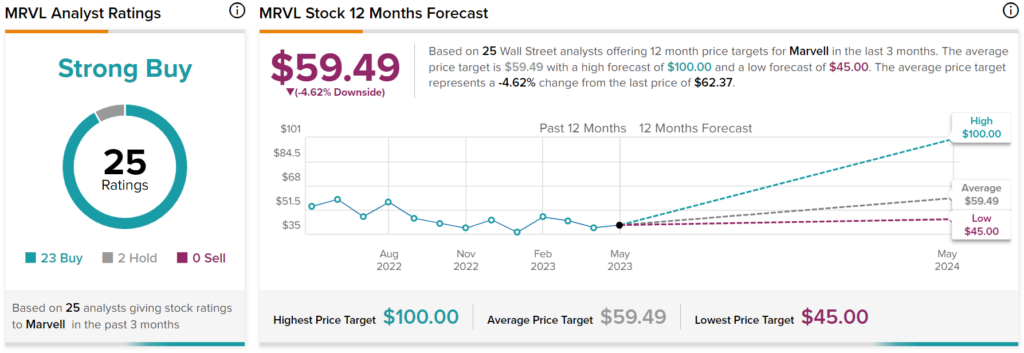

Overall, Wall Street analysts have a Strong Buy consensus rating on MRVL stock based on 23 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. However, today’s surge puts the stock price above the consensus price target.